Guide to Doing Business in the Netherlands

The Netherlands: Strategic Entry & Operations

Over the last decade, we have helped hundreds of foreign businesses and entrepreneurs establish their presence in the Netherlands. This guide is the direct result of that work.

In almost all scenarios, setting up a BV (limited company) is the professional standard. While freelancers may consider a sole proprietorship, it is becoming less attractive for international growth. For e-commerce and trading, we often implement fiscal representation combined with Article 23 VAT deferral to significantly optimize cash flow.

The Main Challenge: Substance

Setting up a subsidiary is rarely just about the registration. The hurdle is "substance"—demonstrating sufficient economic activity to satisfy tax authorities and secure a local bank account. We specialize in building structures that meet these 2026 requirements.

For non-EEA entrepreneurs, residency options are precise. While HSM (High-Skilled Migrant) and Startup visas require significant dedication, American citizens can leverage the DAFT Treaty for a relatively streamlined and cost-effective residence permit.

Taxation remains highly competitive: the 30% ruling offers a massive tax cut for skilled employees (including owners!), while innovative companies can benefit from corporate tax rates as low as 9%.

Get your business in the Netherlands started?

Get in touch with us to learn more about our company services. Our network of professionals gladly helps you starting up your Dutch business.

FAQ on setting up a company in the Netherlands

To set up a company in the Netherlands, you will need to go through the process of company registration. This process can be complex and there are a number of steps that you will need to take in order to complete it. The following steps will give you an overview of the process of company registration in the Netherlands.

Dutch Directorship: Liability & Substance in 2026

Establishing a Dutch BV involves specific responsibilities that go beyond simple registration. In 2026, compliance centers on two pillars: asset protection and fiscal residency.

- Liability (Beklamel): You are personally liable if you enter into contracts on behalf of the BV while knowing (or having reason to know) that the company cannot fulfill its obligations.

- Administrative Duty: In case of bankruptcy, "improper management" is legally presumed if bookkeeping or annual filings are not in order. The burden of proof then shifts to you.

- Banking Access: Traditional banks often require a local resident director; while Fintech alternatives (e.g., Revolut Business) are more flexible, they still require a transparent UBO structure.

- Tax Substance: For holding companies claiming tax treaty benefits, stricter requirements apply—including 50% local board residence and often a €100,000 salary threshold.

Thomas’ Advice: Substance is not "one-size-fits-all." For a simple e-commerce setup, a physical address and local administration often suffice. However, for international holdings, a robust directorship structure is essential to prevent "shell company" claims from foreign tax authorities.

Tax Residency: Central Management & Control

Operating a Dutch BV while residing abroad creates significant tax residency risks. Authorities use the "Central Management and Control" test to determine residency based on where strategic decisions are made, not just where the company is registered.

— Andreas, Tax Advisor

+ The "Mind and Management" Test

Tax authorities look at the "Mind and Management" of the business. If you are the sole director living in the UK or US and making all strategic decisions from your home office, HMRC or the IRS may claim your Dutch BV is actually a local tax resident.

• Strategic Decisions: Budget approval, diversification, and high-level financing.

• Day-to-day: Operational management is secondary to strategic control in this test.

+ 2026 Substance Requirements

To be recognized as a Dutch tax resident and access treaty benefits, your company must demonstrate genuine local "substance":

- Local Management: At least 50% of the board should be Dutch residents.

- Physical Office: An actual workspace used for the company's activities.

- Local Banking & Bookkeeping: The main bank account and records must be maintained in the Netherlands.

- Decision Records: Board minutes must prove that key strategic decisions were physically taken in the Netherlands.

+ Risks of Artificial Structures

Lacking substance is flagged by tax auditors as an artificial arrangement for tax avoidance. This leads to:

- Double Taxation: Both countries claim taxing rights on 100% of global profits.

- Penalties: Administrative fines (up to €19,500 in NL) for misrepresenting residency.

- Personal Liability: Directors can be held personally liable for unpaid corporate taxes resulting from avoidance claims.

Expert Advisory: Instead of high-risk structures, focus on legitimate optimization. This usually involves relocating yourself to the Netherlands (leveraging the 30% ruling) or appointing qualified local directors to ensure management remains demonstrably Dutch.

FAQ on running a business in the Netherlands

Once the company has been set up, there are several things you should arrange. Below are the most frequently asked questions of foreign business owners after they have set up their business.

????️ Key Organizations for Your Dutch Business

Running a business in the Netherlands means dealing with several Dutch organizations. Here's your essential overview:

Registration & Legal

- Notary Public - Incorporates your BV and handles legal documents

- KvK (Chamber of Commerce) - Business register where all companies must register

- IND (Immigration) - Handles visa and residency permits for non-EU founders

Tax & Finance

- Belastingdienst - Dutch tax authority for VAT, corporate tax, and customs (EORI numbers)

- Dutch Banks - ING, ABN AMRO, Rabobank for business loans; Bunq for simple accounts

Employment & Local Affairs

- UWV - Employment office for hiring regulations and labor law

- Gemeente - Your local municipality for permits, licenses, and personal registration

Business Support

- RVO - Government agency offering funding, export support, and business guidance

- ROM - Regional development organizations with funding and local business support

Practical tip: You don't need Dutch residency to start a business, but you'll interact with most of these organizations during setup and operations. Non-EU founders should check the IND website first to understand visa requirements.

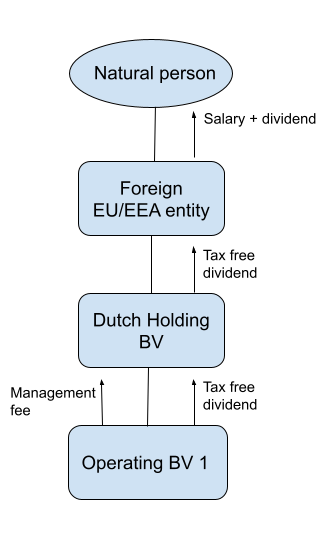

Choose a legal entity and structure

Establishing a business in the Netherlands involves choosing a suitable legal form. Options include sole proprietorship, partnership, and BV limited liability company. However, only the BV can be managed from abroad and offers a low corporate tax rate, making it popular. Foreign entrepreneurs can create a Dutch daughter company, set up a single BV, or form a BV holding structure. The latter, providing tax advantages and bankruptcy protection, is preferable if the Dutch entity isn't a daughter company of a foreign entity.

Dutch holding structure

The Dutch BV holding structure has two main advantages: lower risk-profile and a lower tax burden.

The business activity will take place in the operating BV. The holding BV will deliver 'management services' for the operating bv. Any profits made in the operating bv can be transferred as dividends to the holding BV without having to pay dividend tax. You will also not pay double profit tax over this profit. Plus, there is no inter-company dividend taxed, so this transfer is tax-free. In case of bankruptcy of the operating BV, your assets that you have "moved up" (cash, IP etc.) to the holding will be protected.

Also, if you one day sell the operating company, you will receive the profits from the sale in the holding where you can keep the money without paying additional profit or dividend tax over the sale. You can reinvest this tax-free from the holding into another entity. If you do not have a holding in place, the sales profit will be paid out immediately to yourself and you will pay much higher personal income tax over the sale profit.

Read more about choosing the right legal entity and structure in our guide.

Choosing between building a portfolio inside your BV or privately in Box 3 is a balance of upfront dividend tax versus the annual "wealth tax." Following the final 2026 Tax Plan, the math strongly favors the corporate structure for most investment scenarios.

The 2026 Break-Even Formula

To find the expected return where both options yield the same net result, we compare the after-tax growth in each route. The break-even depends on your BV's profit level due to the Netherlands' progressive corporate tax structure.

• 0.441 = Combined BV tax (19% VPB + 31% Box 2)

• 0.31 = Box 2 "entry toll" to move capital private

• 0.0216 = Annual Box 3 wealth tax (36% × 6.00% deemed return)

Break-even: approximately 11.4%

• 0.488 = Combined BV tax (25.8% VPB + 31% Box 2)

• Other parameters remain identical

Break-even: approximately 8.4%

Practical example: A €1M portfolio earning 10% generates €100k annual profit, staying within the 19% VPB bracket. A €3M portfolio at the same return generates €300k profit, with €100k taxed at 25.8%. Very large portfolios face a lower break-even, making private investing relatively more competitive—but still requiring strong consistent returns to justify the switch.

Strategic Application

The BV remains the default choice for most investors. It's structurally superior for cash, bonds, and volatile assets (crypto, startups) where the annual Box 3 drag would erode capital even in flat or negative years. Private investing only makes sense for aggressive, high-performing portfolios that can reliably beat the 8-11% threshold over the long term.

Loss Protection

A major structural advantage of the BV is that losses are deductible from future corporate profits. In Box 3, you are taxed on a deemed return regardless of actual results—you could pay tax even if your portfolio value drops significantly.

???????? UK Companies: Do you actually need a Dutch BV?

Many UK Ltd companies default to incorporating a Dutch BV for EU market access. However, if your primary need is importing goods and VAT compliance, fiscal representation with Article 23 VAT deferral is typically faster and significantly cheaper than full entity setup.

→ Compare: BV vs Fiscal Representation

→ How Article 23 works

Intercompany Loans: Can you deduct a loss?

???????? UK Ltd to Dutch BV: Group Tax Strategy

Setting up a Dutch BV as a subsidiary of a UK Ltd? In 2026, navigating withholding taxes (WHT) is key to a tax-efficient group structure.

Thomas’ Compliance Tip: To qualify for these exemptions, the Dutch BV must meet "substance" requirements. Ensure your intercompany loans use a market-conform interest rate to avoid reclassification by the Dutch tax authorities.

— Thomas Jaques, NordicHQ

Request a UK-to-NL Group Tax Check

Incorporate and register the BV

Different than in for example the Nordic countries, the Netherlands has a special type of lawyer who has to sign off on the legal paperwork. This person is called a notary (or notary public). Although the process has become more and more digital, a lot of work is still manual. There are very many notaries and some are more modern than others. On top of that, you will have to be on the look-out for professionals who are used to working with international clients.

The notary checks all the required documents. It is possible to sign the documents remotely. If you opt for that, you might need to get some of your documents stamped in your home country. Among other things, the notary will provide you with a so-called power of attorney. The notary will instruct you on what documents you should get stamped (or legalized).

After you have signed everything, the notary will register the BV at the chamber of commerce. Unlike in some other countries, this is a mandatory registration. The costs for the chamber of commerce registration are around 75 euros. It usually takes 24 hours until the registration is finalized after which you will be able to find your company in the register.

Business opportunities in the Netherlands

The Netherlands is a great place to do business, thanks to its strong economy and favorable business climate. There are many opportunities for businesses in the Netherlands, including in the manufacturing, agriculture and services sectors. The Dutch market is also well-connected with other markets in Europe and around the world, making it a good location for export-oriented businesses.

The best industries to start a business in the Netherlands vary depending on the specific sector and region. However, some of the most promising sectors for Dutch businesses include:

- IT products and services: If you are thinking of starting an IT business in the Netherlands, there are many opportunities waiting for you. The Dutch IT sector is thriving, with many companies offering innovative and cutting-edge products and services. In addition, the Dutch market is well-connected with other markets in Europe and around the world, making it a good location for export-oriented businesses.

- E-commerce: the Dutch market is very open to online commerce, with a extraordinarily high rate of internet penetration and a large number of online shoppers. In addition, the Dutch are comfortable making purchases online, and they are used to paying for goods and services with various payment methods.

- Agriculture: The Netherlands is a major producer of agricultural products, including meat, dairy, vegetables, and flowers. There are many opportunities for agri-businesses in the Netherlands.

- Manufacturing: The Netherlands is a leading manufacturer of machinery, chemicals, and other industrial products. If you are looking to start a manufacturing business in the Netherlands, there are many opportunities available.

- Services: The Dutch services sector is thriving, with many opportunities in sectors such as consulting, tourism, healthcare, and financial services. If you are looking to start a service business in the Netherlands, there are many opportunities waiting for you.

The Netherlands is a great place to do business, but there are some challenges that you need to be aware of. Although the country has some distinct advantages, it's important to understand both sides before making your decision.

Direct communication style

If you're used to more indirect communication styles, be prepared for the Dutch to be very direct. They value straight talk and honest feedback, so you may get some bluntness in return if you ask for their opinion. However, this culture of openness is also what makes the Netherlands such a welcoming and inclusive place. People here are quick to start up conversations and strike up new friendships, so don't be afraid to engage with people you meet. You'll likely find that the Dutch are warm and hospitable, despite their sometimes brusque exterior.

Complex tax system

The tax system is quite complex, so you will need assistance to get a clear understanding of the tax structure. There are a range of subsidies and tax deductions. The rates and credits will naturally vary depending on your individual circumstances. With so many factors to consider, it's essential to seek professional advice to ensure you're getting the most out of the system. However, by taking the time to fully understand the tax system in the Netherlands, you can save yourself a lot of money and stress in the long run.

Paperwork and red tape

When it comes to starting and running a business in the Netherlands, sometimes significant paperwork is needed. Much of the paperwork is still in Dutch and not always very friendly to those who are not familiar with it. Systems and processes can be a bit bureaucratic, and it can take a long time to get everything up and running. Chamber of commerce registration and opening a business bank account can be particularly time-consuming. However once everything is in place, you will be able to enjoy the benefits of doing business in this wonderful country.

Good news: The Netherlands might have some red tape, but it is still one of the least bureaucratic and corrupt countries in the world!

Regulated labor market

The labor market is highly regulated, and it's important to make sure you understand the rules and regulations around hiring employees. There are a number of flexible options available, including temporary contracts and part-time work. You can also use employment agencies to help you get started as well as longer term. However, it's important to remember that all employment contracts must comply with Dutch law. This means that you need to be clear about the rights and obligations of both employer and employee. Failure to do so could lead to legal problems down the line. So if you're thinking about hiring staff, make sure you take the time to understand the rules first.

Cost of living considerations

The cost of living in the Netherlands can be expensive, especially in big cities like Amsterdam. House prices and rentals are typically very high, and there is a high tax rate on income and consumption. As a result, it is important to realistically factor the cost of living into your business plans. There are a few ways to reduce costs, however. For example, a location in a smaller city or town, outside of the Amsterdam area, will be cheaper. Initially renting a furnished apartment can be a good starting point. In any case, make sure to budget carefully and track your spending.

Need help navigating these challenges? Contact us – we can help guide you through the maze and make starting up your venture in the Netherlands run much more smoothly.

Business consultants in the Netherlands

Brookz

Brookz is the premier business acquisition platform in the Netherlands Brookz stands…

View ProfileAccounting in the Netherlands

When doing business in the Netherlands, you will need to keep accurate financial records and file regular tax returns. This can be a complex process, so it is important to seek the help of a qualified accountant.

There are a number of accounting services that a company can use in the Netherlands. For example, you can hire an accountant to help you with bookkeeping, preparing your tax returns, and advising on financial and business matters.

We recommend you to consult an accounting professional to find out which accounting services are best suited for your company.

Accountants and bookkeepers in the Netherlands

Tax advantages of doing business in the Netherlands

The Dutch tax system offers a number of advantages for businesses, including a low corporate tax rate for SME's and a wide range of tax incentives. Additionally, the Netherlands has double taxation agreements with many countries, which can help to reduce your tax bill.

Some of the other tax incentives available in the Netherlands include the research and development tax credit, the foreign-trade deduction, and the investment allowance.

Another well-used tax advantage is the "30 percent ruling" which allows foreign employees (including those setting up their own limited company and employing themselves in it) to get a large tax cut on their personal income tax.

Finally, the Dutch holding BV structure offers international businesses certain advantages in optimizing their legal and tax structure.

If you would like to find out how much you will need to pay as a business or person in the Netherlands, check out our tax guide for the Netherlands.

WBSO & Innovation Box - Tax advantages for tech companies

A two-stage strategy to reduce R&D costs and maximize retained profit.

For tech companies, the Netherlands provides a two-stage incentive. The WBSO credit lowers R&D wage costs during development, while the Innovation Box reduces the corporate tax rate to 9% on the resulting profits.

— Andreas, Tax Advisor

+ WBSO: Wage Tax Credit

The WBSO reduces the payroll tax you pay for employees doing R&D.

• Benefit: Roughly €20,000 per R&D employee annually.

• Qualification: Developing new hardware, software, or production processes.

• Rule: You must apply before the work begins for that period.

+ Innovation Box: 9% Tax Rate

Qualifying innovative profits are taxed at 9% instead of the standard 25.8%.

• Requirements: A WBSO certificate is the standard evidence required by the tax office to qualify for this rate.

• SME Limit: Generally worthwhile once innovative profit exceeds €150,000.

+ Mandatory Administration

Incorrect records can lead to repayment of credits and loss of the 9% tax rate:

• Logs: R&D hours must be tracked and updated every 10 working days.

• Evidence: You must keep technical proof (specs, code logs, designs) of project progress.

• Deadlines: Final R&D hours and costs must be reported by March 31st of the following year.

Advisory: WBSO is the standard evidence required to access the Innovation Box. If your WBSO application is not structured with the future 9% corporate tax rate in mind, you risk a rejection during the profit phase.

Tax advisors in the Netherlands

Tax, accounting, legal compliance & insurance

Now that you are the proud owner of a BV with a Dutch bank account, you will at least need to keep an orderly administration, file for corporate income tax return, file and deposit annual accounts. This is done by a Dutch accountant.

Second, you should check if you need to have any legal documents in place. And third, check well if you need to take out any insurance.

The administration and tax obligations are relatively simple and usually not too costly. On average you will pay between 1000 and 2000 euros per year for full administration and tax services. This should include:

- Full bookkeeping package

- Quarterly VAT (BTW) return

- Corporate income tax return

- Annual accounts

- Personal income tax for main director/shareholder

Find a full overview in our guide on accounting and tax returns for SME's.

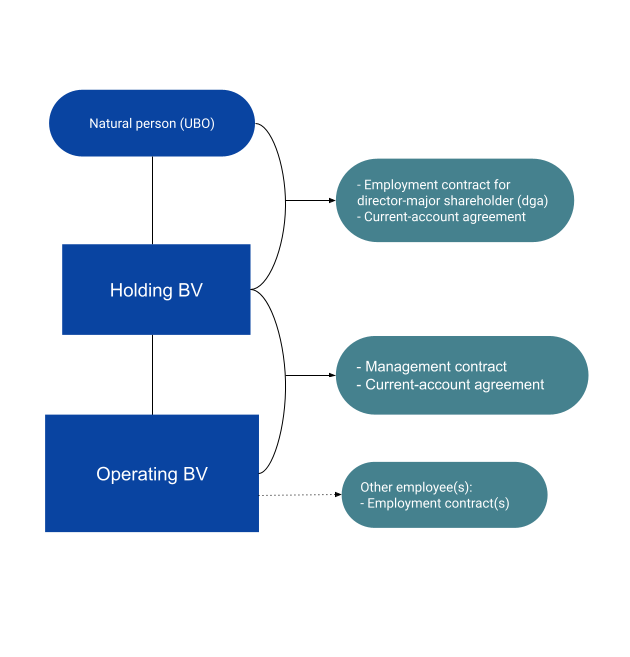

Legal compliance for a BV usually includes:

- Shareholders agreement (if more than 1 shareholder)

- Management agreement (between holding and operating BV)

- Employment contract (if anyone is employed by the company)

- GDPR privacy agreements (if the business deals with personal data)

- Many others!

???? 2026 Update: Cross-Border Remote Work (NL/DE)

As of January 1, 2026, the 34-day rule is officially in effect. Employees living in Germany can work from home for up to 34 days per year without shifting their tax liability to Germany.

Note: Any session over 30 minutes counts as a full day. For structural remote work (1-2 days/week), a Shadow Payroll is still required. Contact us for a compliance check.

Insurance

Company insurance is not mandatory in the Netherlands. However, it is usually wise to take out insurance based on your company's activity and risk-profile. For example, you can take out liability insurance if you want to be sure that you are well protected from claims. These days there are even cyber security insurances to compensate damages from hackers or data leaks.

Opening a business bank account in the Netherlands

Opening a bank account in the Netherlands can be a complex process, so it is important to seek the help of a qualified accountant or consultant.

A bank account can be set up after the company has been registered in the chamber of commerce registrar (KvK). This is done within 24 hours post-incorporation. With the chamber of commerce registration number, you can visit any bank and open a bank account.

It is important to keep in mind that banks in the Netherlands often have specific requirements on who is allowed to open a business bank account. Some require a resident director, others even a Dutch national on the company. These requirements are continuously shifting, so make sure to apply at several banks.

There are a number of different banks in the Netherlands, each with their own set of products and services. It is important to research the different options and find a bank that best suits your needs. If you are looking for large business banks where you can get a business loan and other business services, we recommend ING or ABN AMRO. Perhaps you only need a relatively simple business bank account. In that case you are best of with Bunq. This is a fully-licensed bank that is completely mobile. Their customer service is excellent and their products well thought through.

Read our full guide on opening a business bank account

After you open the business bank account

First of all, do not forget to deposit the share capital in the business bank account. If you fail to do that, you will still be personally liable instead of the company itself.

Furthermore, a VAT number follows on average 7 working days after registration at the chamber of commerce. Obtaining a VAT number has not proven to be a problem for most of our clients. However, you should be aware that opening a bank account is much easier if the company has a resident director on the board.

Finally, it is important to have a well-established address, not just any address.The office address is one of the factors looked at by the tax authorities when they review your application.

Business banks in the Netherlands

Director/Major-shareholder (DGA) Salary in 2026

The general rule is that a Director/Major-shareholder (DGA) in a Dutch BV must receive a "customary salary" (gebruikelijk loon). For 2026, this is set at €58,000. This minimum exists to prevent owners from avoiding income tax by paying low-taxed dividends instead of a fair wage.

2026 DGA Salary Calculation

A DGA salary is the total cost of employment. Unlike regular employees, there are no additional employer social security costs (roughly 20% savings).

| Description | Amount |

|---|---|

| Gross Annual Salary (2026) | €58,000.00 |

| Payroll Tax (Estimated) | - €15,120.00 |

| Zvw Contribution (Healthcare) | - €3,050.80 |

| Net Take-home Pay | €39,829.20 |

Visa and relocation to the Netherlands

EU nationals can freely work, do business and live in the Netherlands. There are no restrictions on where they can work or live. Additionally, there is no need to apply for a visa or residency permit to live in the Netherlands.

If you are not an EU national, you will need to obtain a visa and residency permit in order to work or do business in the Netherlands. The process for obtaining a visa and residency permit can be complex, so we recommend you to consult a legal professional. You can also read more which rules, visas and advantages apply in your situation on the Dutch Immigration website.

???????? US to Netherlands: Expansion Paths

For American founders and enterprises, the Netherlands offers unique treaties and tax advantages. Choose your path below:

The most accessible path for self-employed Americans. Start a business with just €4,500 in capital.

→ Read the DAFT GuideSetting up a Dutch BV as a daughter company for your US entity. Guidance on banking, substance, and DGA salary.

→ US Expansion Master GuideCase: Can a UK Director work from the Dutch office post-Brexit?

Case: Moving Non-EU Technical Teams (40+ Workers)

Why your new Dutch BV can’t sponsor employees yet

Relocation and Visa Experts

Business licenses in the Netherlands

There are no business licences need to start up a business in the Netherlands. However, certain industries require businesses to have additional licences, certificates or other paperwork in order. Examples are parts of the logistics industry, the pharma and biosciences industry and selling financial or insurance products. We recommend you to consult a legal professional if you are active in a regulated industry.

Business contracts and legal compliance in the Netherlands

When doing business in the Netherlands, it is important to have a number of legal contracts in place. These contracts will help to protect your interests and ensure that your business is operating in accordance with Dutch law.

Some of the most important legal contracts for businesses in the Netherlands include:

Employment contracts: All employees in the Netherlands must have an employment contract. The contract should specify the terms and conditions of the employee's employment, including pay, hours, vacation, and benefits.

Contractor agreement: A service contract is a contract between a service provider and their client. The contract should specify the services that will be provided, as well as the price and payment terms.

Terms and conditions / terms of service: General terms and conditions are conditions that are intended to be part of multiple agreements. These terms and conditions are often referred to as the ‘small letters’. They describe conditions, such as delivery conditions and payment conditions but explicitly do not indicate the core of the agreement.

GDPR documents: for example a privacy policy, cookie statement and data processing agreement. Companies that process the personal data of EU citizens must comply with the GDPR unless they can demonstrate that they meet certain conditions specified in the GDPR. Failing to comply with the GDPR can result in significant fines.

Browse all relevant business contracts in the Netherlands in our legal catalogue.

???????? Recruiting & Hiring Talent in the Netherlands

The Dutch job market is highly competitive and digitally driven. To attract top-tier talent in 2026, you need to navigate a landscape where LinkedIn is the absolute standard for professionals.

Thomas’ Compliance Tip: Dutch labor law is very protective. Be aware of the "Ketenregeling" (chain rule) which limits the number of fixed-term contracts you can offer before an employee must be given a permanent role. Always ensure your employment agreements are 100% compliant with the latest 2026 Dutch regulations.

Looking for a local hiring strategy?

Whether you need local employment contracts or want to explore Employer of Record (EOR) solutions to hire without an entity.

→ Get in touch for recruitment and payroll advice

Legal advisors and lawyers in the Netherlands

Office, virtual office and real estate in the Netherlands

The Netherlands is a country in northwestern Europe with a population of more than 17 million people. The Dutch economy is the sixth largest in the world and is dominated by services, which account for more than three-quarters of GDP. The Dutch office market is one of the most expensive in Europe. Amsterdam is the most expensive city to rent office space in the Netherlands, followed by Rotterdam and Utrecht. Despite this high cost, the Dutch office market remains very competitive.

When looking for a virtual office in the Netherlands, it is important to choose a provider that is reliable and offers a range of services that meet your needs. Some of the most important services to look for include:

- A professional and business-like mailing address

- A local Dutch telephone number

- A range of office services, such as meeting rooms, secretarial services, and call forwarding

- The ability to work from anywhere in the world

Read more about offices and registered addresses in our guide

(Virtual) office providers in the Netherlands

Housing for International Entrepreneurs

Finding a rental is a major bottleneck that most international entrepreneurs underestimate. Legislation passed in 2024 and 2025 reduced the Dutch rental supply by 40%. Landlords now strongly prefer Dutch employment contracts over self-employment.

— Leonor, Global Mobility Specialist

+ Legislative Changes & Supply Drop

+ Income Requirements & Risk Profiles

+ Realistic Budgets & Timelines by City

- Amsterdam Center: €2,500 – €3,500 (2-bedroom)

- Rotterdam / The Hague: €1,800 – €2,800

- Haarlem: €1,600 – €2,500 (20 mins from Amsterdam)

+ The €100,000 Savings Benchmark

+ Service Models: Agents vs. Relocation

Warning: Never pay "key money" or wire funds without a viewing. Use official tools to watermark your ID copies. Start your search at least 6 months before your intended move date.

Get funding for your Dutch company

There are a number of ways to get funding for your Dutch company. One of the most popular methods is to raise money from private investors. Private investors can be individuals or companies that are interested in investing in your business. The Netherlands has a wide network of so-called Business Angels.

Another option is to seek funding from venture capitalists. Venture capitalists are investors who are willing to risk their money in order to help young or high-growth businesses grow. They typically invest in businesses that have the potential to generate a high return on investment.

You can also look for funding from government organizations or banks. Government organizations often provide funding to small businesses that have a strong track record and are considered to be high-growth businesses. Banks typically provide loans or lines of credit to businesses that can demonstrate that they have a sound business plan and are likely to repay the loan.

Read more in our guide on financing your business in the Netherlands

Investors and lenders in the Netherlands

Dutch business etiquette

It is important to be aware of the Dutch business culture and etiquette when doing business in the Netherlands. For instance, appointments are generally required for meetings, and punctuality is highly valued. Business dress is usually casual, but in some cases more formal wear is appreciated. Gifts are not typically given during business meetings.

When shaking hands, it is customary to shake hands with everyone in the room. It is also important to maintain eye contact when shaking hands and during conversations. Business cards are typically exchanged after the initial introductions. Post-covid it is accepted not to shake hands. However, in practice it is still the norm.

The business culture varies per industry. You should be aware of the business culture in your particular sector, especially your customers' behaviour. For example, if you selling products or services online in the Netherlands, it is important to understand the Dutch consumer mindset when it comes to online shopping. The Dutch are very price-conscious and they often do research before making a purchase. They also expect very good customer service, so make sure you have a strong customer service strategy in place.

Interested in exploring Dutch business opportunities?

Starting a business in another country is always tricky. However, there are a few countries in Europe where they are so used to setting up new companies that the process is almost effortless. One of those countries is the Netherlands. Compared to its neighbours, the Netherlands has very little bureaucracy and has a very friendly attitude towards international entrepreneurs. That friendliness becomes clear when looking at all the tax incentives and the low corporate taxes in general. This has made the Netherlands the largest recipient of foreign direct investment (FDI) in entire Europe.

NordicHQ has an office in Amsterdam, specialized in guiding foreign entrepreneurs on their business journey to the Netherlands and the rest of the European mainland. Feel free to contact us by email or contact us directly via our contact form.

Ask our advisers

Guide

REQUIREMENTS

REGISTRATION

Registration at the Chamber of Commerce

AFTER REGISTRATION

After the company incorporation

Company formation consultants in the Netherlands

Further reading

Sorry, we couldn't find any posts. Please try a different search.