Guide to Starting a Company in Norway

If you're looking for a new place to do business, look no further than Norway. This Scandinavian country is home to a thriving business community and offers many opportunities for entrepreneurs. In this guide, we'll discuss the advantages of doing business in Norway and provide an overview of the most important aspects of starting and running a company here. So whether you're thinking about expanding your business into new markets or are just curious about what Norway has to offer, read on for more information!

Read more about the process below or request a free quote for company formation in Norway.

Business opportunities in Norway

Norway is a great place to do business, thanks to its thriving economy and stable government. There are many opportunities for entrepreneurs in a wide variety of industries, and the Norwegian government offers a number of incentives to help businesses get started. Some of the most promising industries in Norway include:

1. Technology: Norway is a leader in the technology industry, and there are many opportunities for startups and established companies alike. The government offers a number of grants and subsidies for tech businesses, and there is a large pool of skilled workers to draw from.

2. Renewable Energy: Norway is a pioneer in renewable energy, and the sector is growing rapidly. There are many opportunities in this industry, from developing new technologies to installing solar panels and wind turbines. The government offers generous tax breaks for businesses that invest in renewable energy, and the sector is expected to grow steadily over the next few years.

3. Healthcare: Healthcare is another booming industry in Norway, and the country has one of the highest life expectancies in the world. There are many opportunities for healthcare providers, from hospitals and clinics to home health care services. The government offers a number of incentives for healthcare businesses, including tax breaks and grants for research and development.

4. Maritime: Norway is a major player in the maritime industry, with a long history of shipping and fishing. There are many opportunities in this sector, from port operations to shipbuilding and cargo transport. The government offers a range of incentives for maritime businesses, including tax breaks and subsidies for shipbuilding and port operations.

Challenges of doing business in Norway

One of the biggest challenges of doing business in Norway is the high cost of living. Everything from housing to food and transportation is expensive, so businesses need to be prepared to pay a premium for goods and services.

Another challenge is the country's strict labor laws. Businesses in Norway are required to follow a number of regulations governing working conditions and employee benefits, which can be difficult to comply with.

Additionally, the Norwegian market can be difficult to penetrate, as it is quite small and competitive. Foreign businesses may find it difficult to stand out in a crowded market, and they may need to partner with local companies in order to succeed.

Get your business in Norway started?

Get in touch with us to learn more about our company services. We want to help you move your business in Norway forward.

Process - Norwegian company formation

Starting up a new business sounds easy. In fact, Norway is one of the countries where it is easiest in the world to start a business. Making sure you have thought about absolutely everything when setting up something new can be a real challenge.

There are plenty of excellent public sources of information, but certain issues still require some personal advice. Find the most frequently asked questions about Norwegian company formation below:

5 Steps to Starting a Company in Norway

Basically anyone in the world can set up a Norwegian limited company (AS). However, establishing a company in Norway as a foreigner takes more administrative work than it does for a Norwegian resident or citizen. Check out the steps if you are interested to read what exactly the Norwegian company formation process entails.

Company formation consultants in Norway

Pricing of starting a business in Norway

Requirements to starting a company in Norway

Legal entity and structure

AS or ENK in Norway?

Below is a typical example case of a contractor relocating to Norway:

I am currently living in the UK. There, I am employed by a British company and will become a contractor to this same company, I will invoice them for my salary (around €60k). I am planning to relocate to Norway in the next few months.

I was wondering if you could please confirm which company type I would be best to setup for my particular circumstances?

Answer:

There are two types of companies you can start in Norway. Sole proprietorship or limited company

Sole proprietorship (ENK)

This is the cheapest and simplest way to operate, but when I study your case it appears like your relationship with your customer is similar to being employed with the only difference that you will invoice your salary. With a sole proprietorship you customer will have to pay 14,1% social security and report your invoice to the tax authorities every month.

If this is not what you want, I will not recommend this type of company.

Limited company (AS)

With this type of company, you can send and invoice to your customer and he has no reporting duties.

But when you want to take out money from the company, you must take that as salary. Then your company must pay 14,1% social security to the tax authorities and 10,2% holiday pay to you.

You will then have all the social benefits that everyone in Norway have with free health care.

You can have a pension plan, but it is not mandatory if you are alone in the company.

You are planning on invoicing €60k to your customer. You should be aware that everything is expensive in Norway, and this is a typical salary if you are employed. But it will not be enough to have a decent living if you must pay all the cost in connection with the company.

You should negotiate a higher salary or think twice about this project before you do anything.

Choose a structure: single AS or holding structure

The private limited AS can be set up as a single entity with you as shareholder (or one of the multiple shareholders). Alternatively you could set up a holding structure. In practice, this means setting up two AS companies, one "holding AS" that owns the shares in a "operating AS". Setting up a holding structure instead of a single AS company has two main advantages:

- The risk is spread

- Dividend payments (and gains from a share sale) from the operating AS to the holding AS are virtually tax-free

AS Holding structure

A common structure is to set up two AS companies: one operational AS company owned by a holding AS.

Why would you set up a holding AS and an operating AS?

First of all, accumulated gains/profits in the holding are separated from the operating company in case of a bankrupcy of the operating company.

Secondly, when you sell your operating company, the profit of the sale will flow virtually tax-free to the holding company. Without a holding AS, the entire profit of the sale will be taxed at once.

Third, a holding provides an extra layer of security between you personally and the company's activity.

Fourth, dividends received by a Norwegian resident limited company from another Norwegian limited company or a limited company resident in the European Economic Area (EEA) are basically tax-free. This kind of dividend is 97% exempt from tax, with the remaining 3% taxed at the standard normal corporate tax rate of 22%.

Fifth, accumulated gains in the holding can be reinvested tax-free into another private limited.

In practice the main difference between owning the shares directly as a individual shareholder or through a private limited company (personal holding), is the timing when dividends and gains are taxed. By owning the shares through a holding company you may decide when you want to pay taxes and over which amount. Another large advantage is that a holding structure allows you to reinvest the untaxed funds back from the holding into any other company. This could give you a larger return in the long run.

In many cases it is advisable to own the shares in your operating company through a holding company. This gives you more flexibility, the opportunity to reinvest your profits and the freedom to decide when and how much you want to pay yourself.

Norwegian Branch of a Foreign Company (NUF)

In some cases it makes sense to set up a foreign branche (NUF) rather than a private limited company (AS) in Norway. A NUF can only be used if there is a controlling company abroad.

Registering a NUF

You do not need registered address in Norway. This will save you the cost for an office address in Norway. The fee for registration in the business registrar is lower than the registration fee for the AS. An additional advantage is that there is no share capital requirement.

Documents required to register a NUF:

- Certified copy (from public Notary) of certificate of registration of the mother company from public company register in the country of that company. With information on who is a shareholder and who has the signatory power in the company. This is sometimes one document, but sometimes it contains several documents.

- Certified copy of ID document for person(s) who hold the signatory power of the mother company

- Name and Social security number of all persons who own more than 25% of the shares in the mother company

- If the mother company is owned by one or more other companies, we will need the names and Social Security numbers for the persons in the owner company. We will then also ask you to make an organization diagram.

- The mother company must also make a protocol that says that our contact person should be their representative. This protocol must be signed by a person(s) that, according to the law in the country of the mother company, can decide this

Accounting and a NUF

The accounts of the Norwegian company needs to be integrated into the accounts of the main entity abroad. The setup work for the accounting will be somewhat higher but that is a one-off job.

The NUF and VAT

If you are planning on doing business in Norway with the NUF the company will be subject to taxes in Norway. Once your entity surpasses 50 000 NOK (about 5000 EUR) in revenue it has to be registered in the VAT registrar. However, it is possible to pre-register before the turnover of 50 000 NOK is reached. The requisite is that the company is expected to reach the turnover of 50 000 NOK in less than a month. The rule is that the turnover of 50 000 NOK has to be reached but in practice it has to be reached within 2 months. This is a policy of the VAT-register and not a legal requirement.

The NUF in short:

- For companies with a foreign main entity abroad, without the need of incorporating a private limited company

- A NUF will have its own company registration number

- A NUF does not need a bank account in Norway (but can still have a bank account if that is practical)

- No need for an office address in Norway, but will use the address of the main entity as its address. The billing address will therefore be the main entity's address.

- No share capital requirement

Read more on the pricing for a NUF or contact us directly for a quote.

Opening a business bank account in Norway

Opening a bank account in Norway is a fairly simple process, and can be done either in person or online.

To open an account, you will need to provide some basic information, such as your name, address, and date of birth. You will also need to provide proof of identity and residency.

Most banks offer online banking services which allow you to manage your account from anywhere in the world. This can be a convenient way to keep track of your finances and make payments when you're traveling or living abroad.

The main difference with most other countries in Europe is that you will need to open a bank account in order to open a company. This is because it is the bank that is responsible for doing KYC (know-your-customer) and AML (anti-money laundering) checks of you and your business. Not every bank in Norway accepts foreign clients, so be sure to pick the right one. We can help you in choosing the bank that is right for you.

Business banks in Norway

Office in Norway

In order to successfully set up a company in Norway, you will need at least a Norwegian business address. Like most other countries, Norway's office landscape has changed a lot over the last few years. This has resulted in many new work concepts, such as co-working spaces, incubators and virtual office solutions.

(Virtual) offices in Norway

Taxes in Norway

Tax advantages of doing business in Norway

If your company is doing business in Norway, you may be able to claim a foreign tax credit on your taxes back home. This credit allows you to offset any Norwegian taxes you paid against taxes you owe in your home country. This can be a valuable deduction, especially if your company is making a profit in Norway.

The SkatteFUNN R&D tax incentive scheme is a program offered by the Norwegian government that provides tax breaks to businesses that invest in research and development (R&D). This program can be a valuable way to reduce your tax burden, and can help you offset the high cost of doing business in Norway. All Norwegian companies and branches with R&D projects can apply for a deduction of 19% of incurred costs, limited up to a cost base of NOK 25 million.

Norway is a the country with one of the most tax treaties with other countries in the world. These treaties are designed to help businesses avoid double taxation, and to provide a mechanism for exchanging tax information between countries. If your company is doing business in Norway, it's important to be aware of the tax treaty between Norway and your home country. This will help you ensure that you are paying the correct amount of tax on your income.

Be sure to speak with a qualified accountant or tax advisor to make sure you're taking advantage of all the tax deductions available to you.

Tax advisors in Norway

Find out the amount of taxes you have to pay and which structure/entity works best for you.

How much tax does my company need to pay?

This depends in large part on the amount of profit you will make and which legal structure you choose.

How much tax do I pay in a sole proprietorship?

Income from a sole proprietorship (Enkeltpersonforetak / ENK) is taxed under the personal income tax regime. This income is calculated from your business' revenue minus your business' expenses. This income will generally be taxed somewhere between 33,4-49,6%.

To get an estimate on the amount of tax you will pay over your income in your ENK, use the Tax Calculator.:

- Change the website's language to English

- Choose the correct tax year, marital status and date of birth

- Select "Business" > "Positive personal income from farming, reindeer husbandry, slate quarrying and other business"

- Fill out the amount of income you expect to receive from the business (revenue minus expenses).

- Calculate your tax

How much tax do I pay in a Private Limited Company AS company?

Both the AS company itself and shareholder/employee will pay taxes. A private limited "AS" company is generally subject to VAT (in Norwegian: MVA or "Moms"), employer's social security contribution (if you have employees, including yourself) and corporate income tax. You will have to pay VAT over sold goods or services. VAT you have paid over purchases for the company can usually be deducted from the VAT you have to pay.

Taxes the company has to pay

Profits generated by a private limited company are taxed at the rate of 22% in the 2020 income year. This tax is paid in two instalment in the year after the income year. Private limited companies can decide to pay dividends. Dividends to personal shareholders are taxed at the rate of 35.2% in the 2022 income year, while dividends to companies owning shares in another company are virtually tax-free.

Taxes the shareholder has to pay

Secondly, a shareholder can be taxed in one of two ways as regards income from a private limited company:

- Tax on share dividends

- Tax on salary from the company

Note: As a shareholder you do NOT have to be also an employee in your company.

You, personally, are the shareholder

If you decide to pay out a dividend to yourself from your AS company, this dividend will be taxed at 35,2%.

Another company is the shareholder (AS holding structure)

This is often the case if you have a personal holding AS that holds the shares in your operating AS. Let's say you have made a profit in the operating AS and you would like to pay out some of the profit to the holding as dividend. This inter-company dividend is for 97 percent exempt from tax. The remaining 3% will be taxed at 22%. This makes this kind of dividend virtually tax-free. This works for both Norwegian and other private limited companies in the EEA.

Dividends received by a Norwegian resident limited company from another Norwegian limited company or a limited company resident in the European Economic Area (EEA) are 97% exempt from tax, with the remaining 3% taxed at the standard normal corporate tax rate of 22%.

You are employed by your AS

When you as a shareholder work for the company and receive a salary, the company must pay employer's National Insurance contributions and make tax deductions for you in the same way as for any other employee. The amount that must be deducted in tax will be stated on your tax deduction card which your company retrieves in Altinn.

You must pay tax on any dividends you receive from the company. The tax must be calculated for the year in which the distribution of the dividend is approved by the general meeting. The tax basis is taxed at the rate of 22% for the 2022 income year.

Refunds of withholding tax on share dividends

As a foreign shareholder, you have limited tax liability to Norway for share dividends you've received from Norwegian companies. As a rule, the Norwegian company must deduct 25 percent withholding tax on share dividends. The tax rate may be lower due to tax treaties or Norwegian tax regulations.

If you're entitled to a lower tax rate than the rate deducted on your dividend payment, you can apply for a refund of too much paid withholding tax. Only shareholders who are final dividend recipients can claim a refund of withholding tax.

Tax calculator

Use the tax calculator of the Norwegian Tax Authorities (Skatteetaten) to find out how much you will have to pay.

Administration & Tax filing in Norway

Get your administration and tax returns in order to run your Norwegian business as smooth as possible.

Below you will find the most common post-incorporation services that you have to consider.

Administration

In Norway, keeping a proper administration in order is not only advisable, but also mandatory. Find the process and required documents and data below.

Tax filings and returns in Norway

Your Norwegian company will most likely need to pay taxes in Norway. From VAT to corporate tax and income tax for employees. Find out more how to arrange this in Norway.

(Audited) Annual Accounts

Many companies must publish an annual financial report. If your company is obliged to submit audited annual accounts, you also need a public auditor. Whether or not you are subject to the audit obligation will partly depend on your organisational form and the size of the enterprise.

- Sole proprietorships (ENK) have an audit obligation when the turnover is over NOK 5 million and the balance sheet contains assets worth over NOK 20 million, or the average number of employees is less than 20 full-time equivalents.

- Private limited companies (AS) do not usually have a duty to perform an audit. AS companies can 'opt out' of auditing if the operating revenues are smaller than NOK 6 million, and balance sheets assets amount to less than NOK 23 million, and average number of employees is less than 10 full-time equivalents.

Calculate your accounting fees on our accounting and tax returns page

Employment in Norway

The process of hiring employees in Norway can be challenging, due to the many regulations that must be followed. However, with the help of a good recruitment agency, it can be done successfully.

One challenge when hiring employees in Norway is complying with the country's strict labor laws. These laws cover everything from hiring procedures to employee termination.

However, the main challenge is finding qualified candidates who meet the requirements of the job. The Norwegian labor market is competitive, and there are often not enough candidates available who meet the specific needs of the employer.

Another challenge we often see is how to deal with foreign labour in Norway for companies without a permanent establishment (foreign companies). Read our guide on this topic.

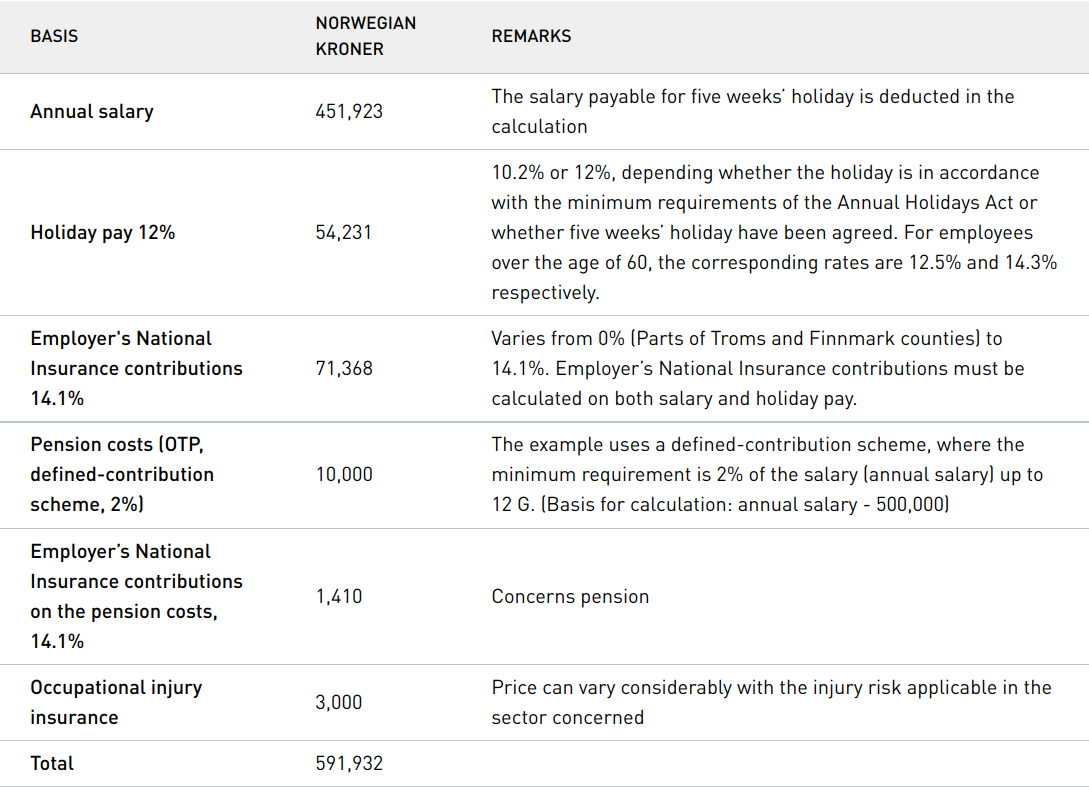

What does an employee in Norway cost?

In this example, we take an employee who earns a gross annual salary of NOK 500,000. We have assumed that it has been agreed that the employee will be entitled to five weeks' holiday.

Permits and licenses

In certain industries, you must have a permit to run your own business. Examples of this are the catering/restaurant and cleaning services sectors.

Compliance and legal contracts

Make sure your company is legally watertight with our contracts and compliancy services.

GDPR Compliance

Norway is a part of the European Economic Area and therefore bound by the GDPR, the General Data Protection Regulation, which resulted in the adoption of a new Privacy Act and other legislative changes to comply with the new data protection rules. Most companies deal with personal data. Therefore you should make sure that you are 100% GDPR compliant. This new privacy law contains rules in the field of privacy protection. Customers and consumers get more rights; companies more obligations. If you do not comply with this, you risk hefty fines. These can amount to 4% of your annual turnover. Make your company GDPR-proof with our GDPR documents. Get in touch to find out more.

Legal contracts

Depending on your type of business, different types of legal documents are recommended. Some legal documents are recommended for almost every business. Examples are General Terms and Conditions and a Privacy Policy.

Shareholders' agreement

This agreement outlines the relationship between the shareholders. This agreement arranges among other things what happens when a shareholder wants to leave the company, non-competition issues etc.

Management agreement

This agreement is usually used between a holding and an operating AS company. As soon as a person or company is engaged to perform management tasks for a company, without the person joining as an employee, you need a management agreement. You use this agreement to make agreements between you and the contractor or client. An advantage of this agreement is that a number of statutory regulations do not apply, such as protection against dismissal, continued payment of sick pay and the right to vacation days. Another advantage is that no payroll taxes and social contributions have to be paid.

General Terms & Conditions

Other words for terms and conditions are terms and conditions, delivery conditions, service conditions, promotional conditions etc. So it makes little difference to the law how you call your conditions. The general terms and conditions for services are suitable for multiple use, which is useful, because you do not have to draw up new conditions for every agreement. To use the general terms and conditions, you only have to declare them applicable and hand them over (this can also be done by e-mail) to the person with whom you are entering into the agreement.

Employment contract

If you will be employing staff, you are obliged to have a written employment contract. This should state the rights and obligations of the employee and cannot be conflicting with Norwegian labour laws.

Get to work with legal contracts and documents in our legal catalogue.

Where to start a business in Norway?

Norway has a rather clear distinction between city and countryside. The majority of Norwegians lives in the city and naturally this is where most business activity takes place. Oslo is considered the business capital of Norway. With over one million inhabitants in the greater Oslo region, this is the main city. Bergen is the second city and is big in shipping and tourism. Stavanger is considered the oil capital of Norway with many business in the petroleum business located there. Trondheim is home to Norway's largest tech university (NTNU), research institute (SINTEF) and a rapidly developing tech scene.

Visa and relocation to Norway

If you're an EU/EEA national, you don't need a work or residence permit to live and work in Norway. Norway is a member of the EEA, and as such, citizens of other EU countries are entitled to freedom of movement within the EU. This means that you can live and work in any EU country without needing a special permit.

However, there are some restrictions on how long you can stay in Norway. If you're staying for less than three months, you don't need to do anything as a EU/EEA citizen. If you're staying for more than three months, you will need to register with the authorities.

For more information on moving to Norway, be sure to check out the website of the Norwegian Directorate of Immigration (UDI).

If you are NOT an EU national and you want to work and live in Norway, you will need to obtain a residence permit.

To qualify for the standard work and residency permit, you must have a job offer from a Norwegian company. The job must also meet certain criteria, such as being in a skilled profession or earning a high salary.

Other types of permits include the "self-employed permit" and the "family reunification permit". The self-employed permit is available to non-EU nationals who want to start their own business in Norway, while the family reunification permit is available to non-EU nationals who have close family members living in Norway.

To apply for a residence permit, you will need to provide a number of documents, such as your passport, birth certificate, and marriage certificate (if applicable). You will also need to provide proof of your employment or self-employment, as well as proof of your income and assets.

It can take several months to process a residence permit application, so be sure to start the process well in advance if you plan on moving to Norway. Be sure to speak with a qualified immigration lawyer to find out which one is best for you.

Fund your company in Norway

Traditionally there are two main types of financing in Norway: investments or bank loans. Both come in many shapes and forms.

These days, many more fors of funding are available. If you want to start a business in Norway, there are a number of funding options available to you. Below are some of the most common:

1. Start-up loans - start-up loans are available from a variety of sources, such as government agencies, banks, and venture capitalists.

2. Grant programs - grant programs are available from a variety of sources, such as government agencies and private organizations.

3. Venture capital - venture capitalists are investors who provide capital to early-stage businesses in exchange for a share of ownership in the company.

4. Angel investors - angel investors are individuals who invest their own money in early-stage businesses in exchange for a share of ownership in the company.

5. Crowdfunding - crowdfunding is a process where individuals or businesses raise money from a large number of people online in order to fund a project or business venture.

Find out more about Norwegian funding, from a crowdfunded investment to a traditional bank loan. Find an investor or lender in our professionals database.

Financing your own company in Norway

A deposit in a company is normally made by the shareholder(s) either giving a loan to the company or by injecting capital through a capital increase. There are a number of factors that will play a role in determining what is most appropriate for the individual shareholder and the company. Below we have listed some:

First of all, an increase in share capital requires a decision by the general meeting of the company. The Norwegian Companies Act sets out a number of procedural rules that must be followed in connection with such a deposit.

Secondly, if the shareholder(s) give a loan to the company, this can normally be done freely without requiring a decision by the general meeting. It is nevertheless important that you formalize the loan with a written loan agreement that regulates the loan amount, interest conditions, term, repayment schedule and whether or not the loan covers other debts in the company. Depending on the detailed loan conditions, there may be a need for a special treatment of the loan in accordance with section 3-8 of the Companies Act. This may include, among other things, a demand for an explanation from the board, as well as for the auditor to confirm this.

Advantages and disadvantages: Loan versus Investment

Business loan to your own AS

Advantages of loan

- Only requires preparation of a written loan agreement.

- Provides flexibility in that the loan can be repaid as needed and according to the company's financial situation.

- Interest payments to the shareholder(s).

- As a starting point, any interest payments will be deductible for the company.

- Loans are considered free equity and can be freely disposed of by the company.

Disadvantages of loan

- Depending on the loan terms, a loan from a shareholder to the company could potentially trigger a need for special treatment of the loan in accordance with section 3-8 of the Companies Act.

- No valuation discount when determining wealth tax.

- Any interest payments will basically be taxable for the lender.

- No right to deduct losses if the loan is lost, but can be converted to equity (capital increase by contribution in kind) with a potential loss deduction in case of later realization of the shares. It is the value of the claim at the time of conversion that is then used as a basis.

Capital investment in your own AS

Advantages of capital injection

- A deposit does not need to be made when depositing cash. It is also possible to make a capital contribution by converting debt into share capital or making a contribution in kind.

- No tax on repayment as long as it does not exceed the paid-in capital.

- Valuation discount when determining the asset value of the shares.

- Skjermingsgrunnlag. This is a tax deduction for private individuals which means that a proportion of share income, profits in sole proprietorships, and interest income on loans to an AS are tax-free.

- Loss deduction.

- Option to give dividends on an ongoing basis.

Disadvantages of capital injection

- Requires a decision by the general meeting of the company, possibly by the board after authorization.

- A capital increase means that the company's articles of association must be amended, which requires a 2/3 majority of both the votes cast and the share capital represented at the general meeting.

- The decision on the capital increase and the amendment to the articles of association must be reported to the Companies Register for registration.

- Similarly, a general meeting resolution is required if the capital is to be reduced again and the money is to be withdrawn.

In conclusion, as a starting point, a loan is both simpler and more efficient than making a capital contribution to the company, as it does not require a cumbersome process and is more flexible in terms of repayment. A capital contribution will be more optimal from a tax point of view, especially when the amount of capital that the shareholder wants to provide to the company is substantial.

Extra services to consider

All other services that can help you and your business.

Phone number / landline

A local phone number makes your company look much more trustworthy. People like to do business with local businesses, so make sure that you have a Norwegian phone number. Luckily this can be done all online these days. We can help you finding the right provider.

Website and marketing

A website is the business card of your company. Without traffic and attention means nothing. We can help you to set up a website, webshop or online platform. Additionally we have the expertise to set up marketing channels specifically for the Nordic market.

EORI

If you are a Norwegian company and you are dealing (import/export) with custom authorities in any EU country, you will most likely need an EORI number. You will receive such a number by applying to the customs authorities in the relevant EU country. Check the validity of an EORI number here.

Company insurance

The private limited company limits your personal liability. Additionally, you might want to consider taking out company insurance.

Most insurances are voluntarily and a few are obligatory. An employer is required to take out insurance for occupational injuries of its employees.

The AS private limited already limits your personal liability to a large extent. In certain situation it can be useful to insure yourself anyway.

We can put you in touch with insurance professionals to give you an personalized offer.

Checklist: Required and Recommended Services for your Norwegian AS

Let's start with a general overview of services that you should and could take out. This is by no means an exhaustive one, but simply a general overview for a simple private limited company in Norway. In case your business has a different or more complicated structure or if you are active in certain industries, other services and documents may be required.

Below you will find a checklist with the most important tasks you should complete in order to successfully set up your company in Norway.

| Private Limited Company (AS) | Partner | |

|---|---|---|

| Founding | ||

| Company Incorporation | ✔ Required | Advisor |

| Share capital deposit | ✔ Required | Bank |

| Registration | ||

| Company registration | ✔ Required | |

| VAT/MVA registration | ✔ Required (if revenue NOK50.000 > ) | Tax advisor |

| Apply for D-number | ✔ Required | Relocation specialist |

| Contracts & Compliance | ||

| Shareholders' agreement | ★ Recommended (if more than 1 shareholder) | Lawyer |

| Current account agreement | Optional | Lawyer |

| Management agreement | Optional | Lawyer |

| Employment contract | Optional | Lawyer |

| GDPR agreements | ★ Recommended | Lawyer |

| Tax & Accounting | ||

| VAT return filing | ✔ Required (if subject to VAT/MVA) | Accountant |

| Corporate income tax filing | ✔ Required | Accountant |

| Annual financial report | ✔ Required | Accountant |

| Bookkeeping | ✔ Required | Accountant |

| Personal income tax return | Optional | Accountant |

| Address & office | ||

| Business address | ✔ Required | Office provider |

| Physical office space | Optional | Office provider |

| Mail forwarding service | Optional | Office provider |

| Norwegian phone number | Optional | Phone/VoIP provider |

| Bank & Insurance | ||

| Bank account | ✔ Required | Bank |

| Business Insurance | ★ Recommended | Insurance company |

| Bank loan | Optional | Bank |

| Investment | Optional | Investor |

8 Steps to get your Norwegian startup ready

Preparation: build solid business case/model.

Perhaps the most important task you should perform is to make a solid business case. Importantly, a business idea is something else than a business model. You should make a proper business plan, not just for others, but mostly for yourself. This does not have to be a formal and static document, but rather a few key statements that can be easily adjusted and fit on one A4 paper. A really great concept to get started with is the so-called Business Model Canvas. This is an extremely easy to use and dynamic document where you can create and test your business plan in no-time.

More than anything else, this type of 'business plan' cuts out all the nonsense, and confronts you with what really matters and what you have not really thought through sufficiently.

Create your business case: Who will be your customer? Can this realistically become successful in Norway? What do you need to make this happen? This business plan is just as important for yourself as it will be to potential investors or lenders.

Test your business case

Conduct a short market research and / or make a very simple prototype of your product or service. Most importantly: do not focus on the details in this stage. You should usually only use a few weeks to get through this stage. The only thing you want it to find out whether there is a market for your product or service in Norway! Get a quick idea of whether your product or service can generate traction.

Choose the right company type

Determine how to structure your company, which legal entity you should use. Make the company future-proof but make it flexible so it can adapt to change (for example, if you expect to bring investors on board in the near future, you should probably set up a AS private limited company and not a sole proprietorship).

Usually this choice will be between a sole proprietorship (ENK) or a private limited company (AS). Other types of legal entities are also available but less frequently used. If you choose the AS, it is important whether you hold the shares directly or using a holding company. We can give you advice on what will be best for you.

Put it on paper

Arrange all of your paperwork well, once and for all. Set up a shareholders' agreement to avoid conflict with partners. Make sure your are compliant with all privacy regulations with GDPR documents. Create terms & conditions that will protect you and your customers properly.

Make sure you arrange legal paperwork and administration correctly from day 1. If financially possible, we recommend you to outsource your legal paperwork and administration. Put all your collaborations with partners on paper (for example a shareholders' agreement).

Arrange your administration

Cover your risks

Take out the right insurance and do not wait for it until problems occur. Certain insurances are mandatory, others are voluntarily. Be aware if any mandatory insurance applies to your business and insure additional risks where suited.

Make the company ready for scale

Ask yourself this question: What would happen if my company grew by 1000% overnight? Make sure your systems and processes (accounting, sales, customer service etc.) can handle growth.

Funding

Think well whether you need funding or whether you should build your business gradually with your own savings. Most business will need funding at one point. Think well about the consequences, advantages and disadvantages of a loan, investment or other type of funding.

Useful Resources & Tools

The Norwegian government institutes have plenty of useful information on their websites about starting up in Norway. Below are some of the most useful websites and tools when you are starting up in Norway.

A good start is to look at the total overview of all the tax rates in Norway. This page is in Norwegian, but can easily be translated into English.

Further, the Norwegian Tax Authorities (Skatteetaten) have made a very extensive online tax calculator. It is standard in Norwegian, but you can change the language to English.

On the Altinn website there are several handy calculators and formulas you can use. For example, calculate how much an employee will cost you in Norway.

To find out all about other companies, it can be useful to use the Proff business registry. On this website you can lookup a lot of public data on other AS companies in Norway.

The best website to compare all sorts of financial products is the website of Finansportalen. This website is made for individuals/consumers but has useful information for business owners as well.

If you are looking into becoming a resident or citizen in Norway, use the online portal of the Immigration services (UDI) to find out what documents and process are required in your situation.

Downloads & Reports on Doing Business in Norway

World Bank 2020 Report - Doing Business in Norway

Get your business in Norway started?

Get in touch with us to learn more about our company services. We want to help you move your business in Norway forward.