Start a Consulting Business in the Netherlands

The Dutch consulting market has been growing rapidly over the last decade. An important reason is that Dutch labour force has become much more flexible over the last few years. Many ex-employees of large consulting, accounting and law firms have started up their own small consulting businesses. On top of that, many expats are starting up small consulting firms in the Netherlands.

This has led to many small consulting firms, which puts pressure on the traditional large firms. Many clients prefer smaller firms with a clearly defined niche, a more personal approach and more reasonable fees. In most cases this client is another business or organisation. However, there are also consulting firms with private persons as their customers.

In this article we will focus on how you should set up a business-to-business (B2B) consulting firm in the Netherlands.

Consulting industries in the Netherlands

There are a few main types of business consultants:

- Management & strategy consultant – Helping often larger business with high-level decision making, where the business and industry are heading towards. These consultants are basically doing what the company’s executives are normally doing. There can be many reasons why companies consult management and strategy consultants. For example, the management is busy with other things, but usually the management wants someone external to look at the company’s internal challenges and opportunities.

- Operations consultants are hired to optimize operational processes. An example is advising on the supply chain of a supermarket chain.

- HR consultants (in Dutch also referred to as P&O consultants) are concerned with the personnel policy and the organizational policy of the client.

- IT consultants advise companies on the objectives they want to achieve in the field of digital work processes and services. This can be system development, integration or the introduction of new systems.

Besides those, legal consulting is very often related to business consulting since legal advice often influence business decisions.

Legal consulting

Starting a legal consulting business in the Netherlands will most likely require some knowledge of the Dutch legal system. Unlike many other countries, everyone can call themselves a legal consultant or legal advisor. This title is not protected. The title “jurist” is reserved only for those who are are graduated or studying law. Those who have completed a Dutch masters in law can put the title “mr.” in front of their name. If you want to have the ability to practice law in court, you will have to complete a full law degree and do a internship at a law firm for +/- 3 years.

Another very common type of consultant that does not really fit the aforementioned consulting types is the marketing consultant.

Marketing consultant

This is probably one of the easiest types of consultancy to enter in the Netherlands. First of all, marketing is not exactly rocket science. For example, most online marketing skills can be learned online and clients often do not care about your education. As a result of that, reputation is everything to a marketing consultant. And reputation comes with results. More than with any other type of consultancy, marketing results can very easily be measured. Just think about Google tools like Google Ads and Google Analytics that measure every tiny movement on your website. If you are consulting in something such as branding a new product line for a business, measuring results might be harder but even here this is possible. On top of that, competition in the marketing consultancy industry is fierce. Therefore, you should have a clearly defined speciality. For example, if you are entering the Dutch market as a marketing consultant, there is a fair chance that you do not know how to market a client’s product or service in the Netherlands. You might be very familiar with your home county’s market and how to market a product over there. In which case it can be very interesting to attract Dutch clients who are interested in expanding your home country.

Acquisition of new clients for your Dutch consulting business

The Netherlands houses very many consulting businesses. The key is to stand out to your specific type of client.

A potential client will be looking for a certain type of expertise, but the way you present yourself might be just as important. From your website, to the way you present yourself, consulting is human work in the end. So the entire package counts. The way your consulting business is perceived by your (potential) clients becomes even more relevant the moment you start hiring. Bringing across your way of doing things, your culture, to your employees is one of an entrepreneur’s greatest challenges.

Once you have established your niche or speciality, the next challenge is to actually find clients who want to pay for your services. There are obvious acquisition channels such as networking events and through business clubs. At the end of the day, nothing quite beats a referral from a previous client or a partner. However, you need to start somewhere and you cannot wait for referrals. Luckily, the Netherlands has a large amount of online platforms especially for professional service providers such as accountants:

- Freelance.nl – probably the most well-known platform that offers many consulting assignments in the Netherlands.

- Marktplaats Zakelijk – The Netherlands’ largest online marketplace has transformed into a job market for freelancers. You will have to search a bit more, but it can pay off. An alternative is to post pay-per-click ads on their platform, which we have good experience with.

- Freelancer.nl – a bit less active these days, but still many assignments in the consulting field.

- HeadFirst – a promising platform, especially for business professionals like consultants.

- LinkedIn – Nothing quite beats LinkedIn, given you have the network and reach.

An alternative to finding you own individual assignments is to work through an intermediary organisation. Such an organisation looks for specific types of consultants at the companies that hire them. The end-client usually pays the intermediary and you invoice the intermediary for your services. A few examples are Between and Undutchables for expats.

Consulting fees in the Netherlands – how much can you charge?

This has to be one of the most frequently asked questions we receive. It is common practice for clients in the Netherlands to negotiate about your consulting fee.

What you are worth is determined by the market, by supply and demand. If you have an in-demand special skill or knowledge no one else has, it is much easier to charge higher rates. Another factor is the duration of the assignment. A one-day job usually has a much higher hourly rate than a 6-month project.

The fact is that many consultants overestimate what rate the can charge (see below).

What rate you can ask for is equal to the maximum rate a client is willing to pay. You should take into consideration whether it is likely that your client will give you any follow-up assignments. If that is the case and price is an important factor to the client, that could be a reason to charge a bit less. On the other hand, the moment you go down in price it will be harder to ask for a higher fee in future assignments for the same client.

So what are the average fees the various types of consultants charge on average?

| Consultant type | Hourly rate (€) |

|---|---|

| General business consultant | 60-70 |

| Management consultant | 90-110 |

| Strategy consultant | 100-120 |

| Legal consultant | 80-150 |

| Marketing consultant | 50-100 |

| HR consultant | 70 |

| IT consultant | 90-110 |

Managing your clients

Your clients are at the core of your consulting business. Needless to say, you want to make and keep them happy. Recurring revenue is what you are after and that comes only with long-lasting client relationships. To manage those relationships we recommend you to step away from spreadsheets (or worse) and move towards Customer Relationship Management (CRM) software and apps.

Finding the right CRM can be a real challenge, but is always worth the time and investment. Just don’t pick the first one you come across, but do a little research. For example, look well if the CRM has integrations with other software you use such as your accounting or email solutions. Some CRM’s integrate perfectly with Google’s products, while others are built around the Microsoft ecosystem. A good starting point is to visit one of the comparison websites to compare the various systems.

Another important tool to build trust is business proposal software. This is also a great way to keep track of deals and close them. We recommend you to use a system that you can integrate with your CRM system. Our favorites are Pandadoc and SignRequest, but there are many other great ones out there.

Communication with clients in the Netherlands

As a consultant, communication is key. It is important to remember that Dutch business culture and communication might not be the same as what you are used to. Dutch business clients are known to be direct and usually want to get straight to business. To some foreign consultants, new to the Dutch way of doing things, this might come across as rude. From our own experience: that is by no means the case. A few tips on dealing with Dutch clients:

- Be to-the-point but polite

- Be transparent about your conditions and pricing.

- Make sure deadlines are met and you show up on time at appointments.

- Sending Whatsapp or text messages to a client’s personal number is not common practice. It is usually better to call or email.

On a side-note, if you are sending sensitive business or personal information to a client, we recommend you to use a safe email solution that allows for encrypted emailing. There are a few great providers on the market. The Dutch company Zivver is our favourite, since it integrates really well with both Google Workspace (Gmail for business) and Outlook. Not only does this secure you from data leaks. It makes your consulting firm look professional and caring for your client’s data security.

Accounting software for consultants in the Netherlands

A small accounting firm usually has a relatively simple administration. For most small consulting firms, the following applies:

- Your firm invoices clients on an hourly or project basis and receives payment of those sales directly in its bank account.

- Most incoming invoices for costs are received through email.

- There might be a few paper receipts, for example for a customer dinner or a store purchase.

- There are no cash or credit card payments.

- Your consulting company has at least one employee (yourself).

We advise you to use an accounting system that is created for the Dutch legal and tax system. There are a few large American firms that have excellent accounting software that you could use. Unfortunately these systems are not always perfectly in sync with the Dutch system. Therefore we recommend you to use any of the systems below:

These services all offer a cloud-based solution which you (and your accountant) can access on your computer and phone. All these solutions have a receipt scanner mobile app, so you can easily book any paper receipts into your accounting system. Finally, these systems are widely used by many accountant offices in the Netherlands. If you decide to one day switch accountant, it is much easier to hand over an existing administration than if you need to switch accounting software. All or parts of the accounting can be outsourced. You can find more about accounting services here.

Joining consultancy associations in the Netherlands

For some occupations, being a member of a association or union is mandatory. For example, registered accountants are a member of the accountant association. In addition being a member improves your credibility and helps to build a network.

Business consulting is not specifically regulated by law. However you can still choose to become a member of an association. An example is the Raad van Organisatie Adviesbureaus (ROA). If you are a ROA member, you are bound by a code of conduct. There are numerous other associations aimed at businesses in the various consulting niches. Market research consultants, for example, can become a member of the MOA.

Create a solid business plan

More than anything else, a business plan is a tool to make sure you are on the right track. A good business plan does not only contain financials and some reasons why you will do things differently than the competition. It makes it crystal clear what your business will be and how you will achieve that. In our opinion, a business plan should always be a ΅live” document which you can update based on changing circumstances and new information. However, “sticking to the plan” is often still a good idea. Do not drop an idea just because a few people have talked negatively about it. Our favourite tool to create an easy to maintain and to-the-point business plan is the Canvas business plan. The one page business plan is a similar great tool to find out what your business really is and get things moving.

A consulting business starts by solving a real problem

As a small or medium-sized consulting company, we usually recommend clients to choose a well-defined niche. In the consultancy world, a niche usually means specialising in a certain type of client. To determine your niche, you usually look at what skills and knowledge you have that could benefit clients in the Netherlands. As a consultant you are solving a business problem for a client. That is why in determining your firm’s business case, we need to look at what problem you are actually solving.

Example of a consultancy business case

Let’s take our own business, NordicHQ, as an example. NordicHQ is, among other things, a consulting business. We advise clients from all over the world how to set up a business in the Netherlands and the Nordics.

Determine the problem

This idea started with a practical issue problem we wanted to solve: It is difficult to set up a small or medium-sized business as a foreigner in another country due to a lack of reliable information and access to the right service provider(s).

This is the issue we experienced ourselves and heard frequently from people around us. We knew the problem was relatively common.

We decided to break down that problem into smaller pieces: what was it that made it particularly difficult to set up a business in a foreign country like the Netherlands? From own experience, asking around and doing some market research we concluded that:

- It is difficult to find reliable information (in English).

- It is difficult to find reliable service providers that are not expensive law firms.

- The service providers you will find cannot help you with the entire range of services that you need.

Reasons for the problem’s existence

A next question should be why this is the case and why has this “problem” not been solved by existing (legal) consultants and other service providers. When we looked into the competition we found that:

- The legal industry and adjacent industries (accounting, compliance etc.) have never really made the leap towards transparency and online because their business model does not benefit from it (very often it is in fact the opposite).

- For most clients, the setting up of a new company is a one-off procedure. Customers will not complain if it does not go as smoothly as hoped for. Many clients expect bureaucracy and hassle and are happy enough that they have (eventually) succeeded in opening a company.

- Most service providers do not look beyond their own borders. Therefore most information is in the country’s native language. There is also a tendency to use difficult language that most clients do not understand.

- The service providers with an international scope are primarily focused on having their clients pay less tax, not so much their other interests.

Solution to the problem

Once we had established the core problem, how this manifested itself in practice and the reasons the problem still persisted, we could come up with a solution:

Provide a ‘one-stop-shop’ where we offer all services a foreign entrepreneur starting up a business in the Netherlands is looking for. Primarily ourselves, partially through a network of reliable partners. We have complete focus on the needs of a foreign entrepreneur, at the core a well-functioning customer experience for English speaking clients. Most importantly, we need to make sure that we communicate with clients and on our website using easy-to-understand and transparent information.

Insurance

We recommend you to take out professional liability insurance as a consultant. Especially if you are operating from a sole proprietorship but also in the Dutch limited company. This type of insurance will cover any damages resulting from a mistake in any advice you give a client. This can be any error error in your or your employee’s work or advice that results in financial loss for your client.

Business liability insurance on the other hand provides coverage against liability for damage that you or an employee cause to property or persons. For example, damage from knocking over a cup of coffee over a customer’s laptop or someone tripping over you and breaking a leg

There are dozens of less crucial insurance products you can choose. From legal insurance that covers legal costs and provides legal assistance in case of conflict, to cyber security insurance in case of data leaks and hacks.

Legal form and structure for a consultancy business

If you will be the sole consultant in your own consulting firm, you could either set up a sole proprietorship (Dutch: eenmanszaak) or a Dutch limited company (BV).

The sole proprietorship has some tax advantages for small startups. The BV is a more common entity for slightly more mature companies, offers protection of private assets and is more tax-friendly once the company is more profitable. If you choose the BV-route for your consulting firm, you can also opt for a so-called BV holding structure. This structure, among other things, saves taxes, limits liability even further and provides for building up pension. You can read all differences and advantages of the legal structures in our guide. You can also contact us directly.

Contracts and legal work for consulting businesses

There are a few specific contracts and legal documents every consultant in the Netherlands should have available.

Arguably the most important one is the assignment agreement (also called contractor agreement or freelance contract). This freelance agreement arranges the terms under which a contractor/consultant works for a client. The main difference between the freelance contract and an employment contract is that the contractor is not subordinate to the client. There is no legal requirement to sign a freelance contract with your client, but it is highly recommended. You can create an assignment agreement once and edit the contract for every new client.

In addition to the freelance contract, you should set up general terms and conditions for your services. These are conditions that are intended to be part of multiple agreements. These terms and conditions are often referred to as the ‘small letters’. They describe conditions, such as delivery conditions and payment conditions but explicitly do not indicate the core of the agreement.

A third legal document that consultants often use in practice is an NDA or non-disclosure agreement. It can be useful to use your own NDA, even if it concerns your client’s company secrets you want to protect. It is also a sign of goodwill to offer a client that you are willing to sign one.

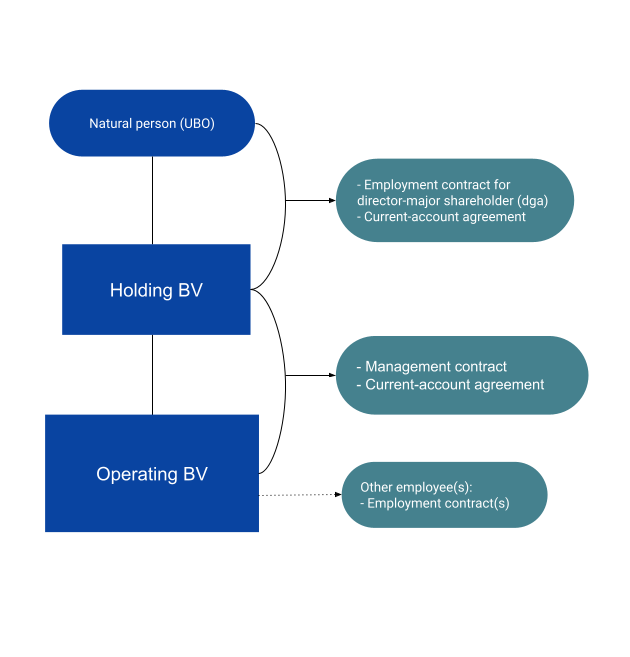

Contracts for a BV company

If you are operating your consulting business from a Dutch limited company you will most likely be employed by the company. In which case, you should sign an employment contract between the company and yourself and any other employees. Furthermore, you should always have a current account agreement between you and your BV company. The facilitates borrowing from and to your company without having to set up loan agreements for every single transaction.

Does the company have two or more shareholders? In that case you should set up a shareholders’ agreement between the shareholders. Other than the company’s founding document this contract describes the relationship between the shareholders, not between a shareholder and the company.

Finally, if you have chosen a BV holding structure, you should set up a management contract between the holding BV and the operating BV.