There comes a moment in many European businesses’ lives when internal resources just aren’t enough. Fueling expansion, solidifying growth, or transforming that brilliant idea into reality needs external support. Selling equity for an investment can make sense, but there are several other ways of structuring it. Let’s quickly go through the different options. If you […]

Tag: Denmark

What if the Nordic countries were one country?

What if the Nordic countries of Norway, Denmark, Sweden, Finland and Iceland united and formed one power block in Northern Europe? How would they rank economically, militarily, in terms of happiness? And why would this even work? The United Nordics would be Global GDP Heavyweights 2023 data further solidifies the argument that a United Nordics […]

The SAFE: A Simpler Way to Invest in Startups

The journey of a startup is fueled by innovation, but also by access to capital. In this fast-paced landscape, a financing mechanism gaining popularity is the SAFE. Here’s a breakdown of SAFEs, why they’re appealing, and the nuances to be aware of. What is a SAFE? A SAFE stands for Simple Agreement for Future Equity. […]

The European Dream: A Guide for American Entrepreneurs Moving to Europe

The statistics are telling: From 2013 to 2022, the number of Americans in the Netherlands grew from about 15,500 to 24,000; in Portugal, it tripled to nearly 10,000; and in Spain, it increased from around 20,000 to 34,000. Moderate to steady growth was observed in countries like France, Germany, and the Nordics. Britain alone saw […]

A Guide to Cyber Security for SMEs in Europe

Every day, businesses fall victim to cyber crime. Whether it’s a ransomware attack that locks down your computer systems until you pay up, or sensitive customer data being stolen and sold on the dark web, the risks are real and growing. If you’re an SME, it’s crucial that you take steps to protect your business…

R&D tax breaks and incentives for businesses in Europe

Governments all over Europe want to attract innovative business activity. Those are businesses that perform ground-breaking research and development (R&D) activities. European countries, and the EU as a whole, give incentives to these businesses. For example to create a more technologically advanced economy, stimulate job growth or tackle climate-related challenges. Such incentives are offered through…

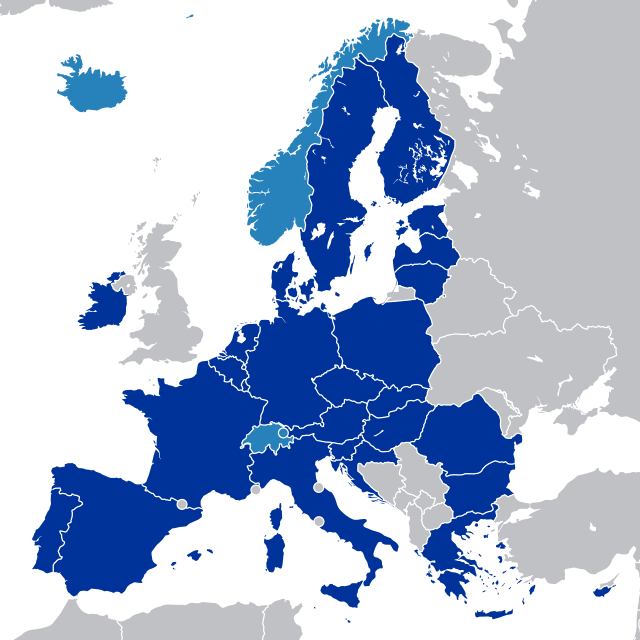

Business in the European Single Market 101

The European Single Market (ESM) is the largest internal market in the world. It allows for the free movement of goods, services, capital and people within the European Union and Norway, Iceland and Liechtenstein. These last 3 countries participate in the EU’s internal market without being members of the European Union. The Single Market works…

2023 – The European Year of Skills

The European Union is launching the Year of Skills in 2023, with a focus on upgrading workforce skills across Europe to ensure that the EU can be competitive in world markets. This bold project brings together a range of strategies and resources that both employers and employees can access to develop their skillsets. The EU’s…

Made in Europe

As an entrepreneur, you know that to be successful you need to offer a quality product or service. But did you know that some of the best products in the world are made in Europe? From fashion to food, automobiles to automation, there are tons of high-quality goods coming out of countries like Italy, Sweden,…

How to avoid bureaucracy and corruption when doing business in Europe

Simple! Avoid doing business in bureaucratic and corrupt countries. Bureaucracy is always associated with complex and intransparent processes. This leads easily to corruption and cronyism. The delayed or obstructed processes make it very difficult for businesses to operate effectively and can ultimately discourage investment. The often quoted World Bank’s “Doing Business” report, in 2020 ranked…