The journey of a startup is fueled by innovation, but also by access to capital. In this fast-paced landscape, a financing mechanism gaining popularity is the SAFE. Here’s a breakdown of SAFEs, why they’re appealing, and the nuances to be aware of. What is a SAFE? A SAFE stands for Simple Agreement for Future Equity. […]

Tag: UK

Work permit for UK director’s business visits from UK to EU country?

Question: I am wondering whether I, as a UK citizen and resident, can set up a BV and then visit the Netherlands and work at our Amsterdam office (here we will have several of Dutch employees). The visits will be from a few days to a week or so after which one of the other […]

Establishing a European NGO as a US Nonprofit

Question: Being a US-based nonprofit, we’re looking to expand our presence into Europe. Which European countries would you recommend considering the following criteria: 1) Incorporation costs; 2) Simplicity and speed of the registration process; 3) Ongoing maintenance costs; 4) Necessity of a physical office, given our remote work model; and 5) Other notable advantages or […]

Q&A: VAT in Dutch EU Operations (UK Ltd. main office)

Question: As the CEO of a UK-based enterprise that specializes in distributing consumer electronics to various regions in the UK and Europe, we’re contemplating expanding our operations next year by establishing a subsidiary in the Netherlands, with our main UK entity as the shareholder. We’re considering partnering with a third-party logistics center in a central […]

The European Dream: A Guide for American Entrepreneurs Moving to Europe

The statistics are telling: From 2013 to 2022, the number of Americans in the Netherlands grew from about 15,500 to 24,000; in Portugal, it tripled to nearly 10,000; and in Spain, it increased from around 20,000 to 34,000. Moderate to steady growth was observed in countries like France, Germany, and the Nordics. Britain alone saw […]

A Guide to Cyber Security for SMEs in Europe

Every day, businesses fall victim to cyber crime. Whether it’s a ransomware attack that locks down your computer systems until you pay up, or sensitive customer data being stolen and sold on the dark web, the risks are real and growing. If you’re an SME, it’s crucial that you take steps to protect your business…

R&D tax breaks and incentives for businesses in Europe

Governments all over Europe want to attract innovative business activity. Those are businesses that perform ground-breaking research and development (R&D) activities. European countries, and the EU as a whole, give incentives to these businesses. For example to create a more technologically advanced economy, stimulate job growth or tackle climate-related challenges. Such incentives are offered through…

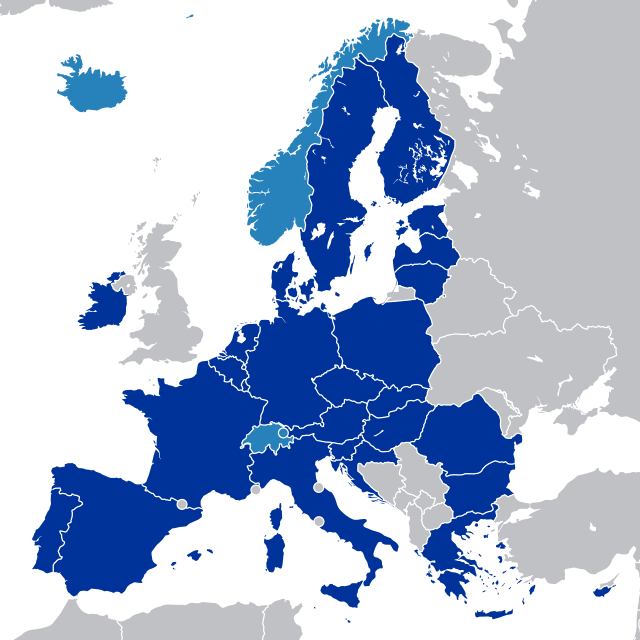

Business in the European Single Market 101

The European Single Market (ESM) is the largest internal market in the world. It allows for the free movement of goods, services, capital and people within the European Union and Norway, Iceland and Liechtenstein. These last 3 countries participate in the EU’s internal market without being members of the European Union. The Single Market works…

Tax questions for UK Ltd setting up a BV entity

We are close to moving ahead with the need to form a BV entity and fit this into our group structure. The main company is a UK Ltd. I understand that it is usual for Netherlands-registered entities to levy a witholding tax of 15% on any dividend payments made to shareholders We also, however, understand…

Sponsor UK employee for visa in the Netherlands

We have a UK citizen who we are looking to employ in the Netherlands and my understanding is that we need a Netherlands based company in order to sponsor his application for a work permit. On this subject, we also need support on completing the relevant application forms – is this also something that you…