European healthcare systems dominate global rankings, with Netherlands leading at #2 worldwide and six European countries in the top 10 globally according to 2024 Commonwealth Fund analysis. For expats and international entrepreneurs, the landscape offers excellent quality care but varies dramatically in accessibility, costs, and bureaucratic complexity. Switzerland delivers premium care at premium prices (CHF 300-400 monthly), while Spain provides universal coverage that rivals the world’s best systems at a fraction of the cost.

The research reveals stark differences in expat experience: Netherlands offers 95% English proficiency among healthcare workers and straightforward €149 monthly insurance, while France provides world-class care but requires navigating complex bureaucracy with 6+ month processing times. Nordic countries excel in quality and English accessibility but impose higher tax burdens, and Eastern European nations provide cost-effective care with growing medical tourism sectors.

Methodology and Data Sources

This analysis synthesizes data from six major healthcare measurement systems to provide comprehensive comparisons tailored for international relocators. The Euro Health Consumer Index (discontinued 2018, using projected 2023 rankings), OECD Health Statistics 2024, Bloomberg Global Health Index, Numbeo Health Care Index 2024 (49,090 user surveys), Commonwealth Fund Mirror Mirror 2024 rankings, and WHO Global Health Observatory 2024 data form the foundation.

Research focused on expat-relevant criteria rather than general population health metrics: English language accessibility, foreign resident registration processes, insurance requirements, waiting times by procedure type, private healthcare options, and system navigation complexity. Data prioritizes 2024-2025 information where available, with country-specific analysis covering insurance costs, residency requirements, and practical access barriers.

The methodology balances outcome-based performance metrics with user experience data, recognizing that statistical health outcomes may not reflect the expat experience of accessing care in a foreign system.

European Healthcare Rankings

European countries dominate global healthcare excellence, claiming 11 of the top 20 positions across international indexes. The rankings reveal fascinating patterns when viewed through an expat lens rather than general population health metrics.

Overall Performance Rankings (2024)

Top Tier Countries:

- Netherlands – Commonwealth Fund #2 globally, Numbeo #1 Europe (78.9)

- Switzerland – EHCI leader (893 points), premium private system

- Denmark – Numbeo #3 Europe (78.0), Nordic excellence

- France – Commonwealth Fund #5 globally, Numbeo #2 Europe (78.1)

- Spain – Bloomberg #1 globally (92.75), universal coverage

- Norway – EHCI #3 (857 points), comprehensive welfare model

- Sweden – Commonwealth Fund #6, Bloomberg #6 globally

- Germany – High spending (12.7% GDP), mixed performance rankings

- Austria – Strong universal system, 99%+ coverage

- Belgium – EHCI #5 (849 points), comprehensive social insurance

Key Performance Indicators

- Life Expectancy Leaders: Spain (83.5 years), Switzerland (83.4), Netherlands (82.3)

- Health Spending Efficiency: Netherlands excels in value-for-money metrics

- Patient Rights: Netherlands and Norway lead in patient-centered care

- System Accessibility: Switzerland and Netherlands minimize unmet healthcare needs

- Administrative Efficiency: European systems universally outperform other global regions

Top Countries for Expats

Netherlands

The Netherlands earns its #2 global ranking through exceptional expat accessibility combined with world-class outcomes. The hybrid system mandates private insurance for basic care while maintaining universal coverage principles.

Insurance and Costs: Monthly basic insurance costs roughly €149 (2025), up from €138 in 2024, with €385 annual deductible. Government subsidies reduce costs for lower-income residents, and supplementary insurance (€10-80 monthly) covers dental and specialized services. The system achieves 99%+ population coverage with minimal unmet healthcare needs.

English Language: Healthcare workers demonstrate 95% English proficiency, with major cities offering dedicated English-speaking GP practices and specialist services. Patient portals and digital services operate in English, eliminating language barriers that plague expats in other systems.

Access and Quality: GP registration covers 95% of citizens in a gatekeeping system that ensures continuity of care. Specialist wait times average 2-4 weeks for non-urgent care, with private options providing immediate access. Emergency response averages 8 minutes urban, 15 minutes rural, with 100% emergency care coverage.

Switzerland

Switzerland operates Europe’s only entirely private healthcare system, delivering world-class quality at premium prices. All residents must purchase mandatory insurance from regulated private insurers offering standardized basic benefits.

Cost Structure: Monthly premiums range CHF 300-397 ($338-447) in 2025, representing an 8.7% increase. Deductible options span CHF 300-2,500, with annual out-of-pocket maximums capped at CHF 700 for adults. Government subsidies assist up to 40% of the population, making the system accessible despite high nominal costs.

Quality: Switzerland leads global healthcare innovation, particularly in cardiology and oncology. Health expenditure reaches 11.4% of GDP (highest in Europe), supporting world-leading medical technology and specialist care. Life expectancy of 83.4 years reflects excellent health outcomes.

Expat Experience: Urban areas provide excellent English-speaking medical services, with private clinics specializing in international patients. The mixed specialist access system allows direct consultation for some services while requiring referrals for others, providing flexibility for expat preferences.

Germany

Germany’s dual system serves 99.9% of the population through either statutory health insurance (85%) or private coverage (15%). The income-based contribution system provides comprehensive coverage for employed residents while offering premium private options for high earners.

System Structure: Public insurance costs 14.6% of income (split equally with employers), while private insurance ranges €230-500 monthly with risk-based pricing. Employees earning over €66,600 annually can choose private coverage, which provides faster access and enhanced services.

Expat Integration: Employment automatically triggers insurance registration, simplifying access for working expats. Major hospitals provide English-speaking departments and interpreters, with university medical centers typically offering strong English language support. Private insurance holders receive 3x faster specialist appointments than public system users.

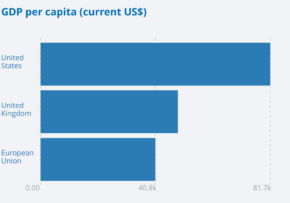

Performance: Germany leads European health spending at 12.7% of GDP ($8,166 per capita), supporting advanced medical technology and high provider density. The system maintains excellent clinical outcomes while providing immediate coverage for employed expats.

France

France’s PUMA system provides universal coverage after three months of legal residency, historically ranking #1 globally by WHO for overall health system performance. The social security foundation covers majority costs while supplementary insurance (mutuelle) fills coverage gaps.

Coverage and Costs: The public system covers approximately 70% of medical costs, making supplementary insurance essential for comprehensive coverage. Carte Vitale provides automatic reimbursements, though processing can take 6+ months for new residents.

Access Challenges: Registration requires extensive documentation and 3+ month residency proof for non-workers. Rural areas experience 52% longer wait times than urban centers, and specialist wait times have doubled since 2019. GP appointments now average 10 days versus 4 days in 2019.

English: Major cities, particularly Paris, offer good English-speaking medical services. Private insurance provides access to English-speaking physicians, while public system language support remains limited outside major metropolitan areas.

Denmark

Denmark’s tax-funded universal system provides free healthcare at point of service for all legal residents, supported by advanced digital health infrastructure and consistently high patient satisfaction ratings.

System Efficiency: Average hospital treatment wait times of 38 days have returned to pre-COVID levels, demonstrating system resilience. The decentralized administration across regions maintains consistent quality standards while allowing local adaptation.

Digital Leadership: Denmark leads European e-health innovation with comprehensive digital services available in English. Healthcare apps and booking systems provide seamless access for English-speaking residents, while high English proficiency among medical staff eliminates language barriers.

Expat Experience: CPR number registration typically takes 2-4 weeks, providing rapid system access for legal residents. Yellow health cards automatically arrive at registered addresses, and GP selection offers flexibility in choosing primary care providers.

Practical Guide for Expats

Insurance Requirements by Status

EU Citizens benefit from significant advantages through European Health Insurance Card (EHIC) coverage and S1 form benefit transfers between countries. Residency establishment typically provides immediate public system access with shorter waiting periods and streamlined documentation requirements.

Non-EU Citizens face more complex requirements, typically needing private insurance initially with longer waiting periods for public system eligibility. Documentation requirements prove more stringent, and private insurance often remains necessary throughout extended stays.

Registration Timeline

Week 1: Address registration proves essential in Germany (2 weeks maximum), Netherlands, and Nordic countries. This triggers the healthcare registration process and establishes legal residency for insurance purposes.

Month 1-4: Netherlands requires insurance within 4 months with €402 penalties for late enrollment. Germany mandates coverage within the first month of employment or residency. Switzerland enforces 3-month deadlines with automatic enrollment if no choice is made.

3-6 months: France requires the longest processing times, with Carte Vitale often taking 6+ months. Most other systems provide temporary coverage during processing periods, ensuring continuity of care.

Cost Comparison

Monthly Insurance Costs:

- Netherlands: €149 basic + €10-80 supplementary

- Switzerland: CHF 300-397 ($338-447) mandatory private

- Germany: 14.6% income (public) or €230-500 (private)

- Sweden: Tax-funded with €375 annual private option

- Ireland: €500-4,000 annual private coverage

Out-of-Pocket Maximums:

- Sweden: ~$94 medical + ~$211 prescriptions annually

- Norway: ~$290 annual maximum (free for children/pregnant)

- Switzerland: CHF 700 ($787) adults, CHF 350 children

- Netherlands: €385 annual deductible

Private Care Costs: European private healthcare typically costs 2-4x less than US equivalents, with major surgeries averaging $14,000 in Italy versus $40,000+ in America. Private consultation fees range €40-100 versus €150-300 in the US.

Regional Overview

Nordic Countries

Nordic countries (Denmark, Sweden, Norway, Finland) represent the gold standard for universal healthcare, achieving 75-85% tax funding with 97% cost coverage in Sweden. These systems excel in preventive care, mental health services, and comprehensive coverage including rehabilitation.

Strengths: Excellent English proficiency among medical professionals eliminates language barriers. Comprehensive coverage includes mental health and preventive services often excluded elsewhere. Digital health services lead globally in accessibility and user experience.

Considerations: Higher tax burden (20-50% income tax plus social security up to 31%) funds comprehensive services. Adult dental coverage remains limited, and specialist wait times can extend beyond other European systems for non-urgent care.

Western Europe

Germany, France, Netherlands, and Belgium offer diverse approaches to healthcare excellence, from Germany’s employer-based system to Netherlands’ regulated private market and France’s social security foundation.

Netherlands leads in English accessibility and straightforward registration. Germany provides immediate coverage through employment. France offers world-class care but requires patience with bureaucracy. Belgium provides good urban English availability with comprehensive coverage.

Mediterranean Countries

Spain, Italy, and Portugal deliver exceptional healthcare value, with Spain ranking #1 globally in Bloomberg’s health index while maintaining universal coverage for residents.

Spain provides free universal care for legal residents with world-leading life expectancy (83.5 years). Italy offers comprehensive coverage through SSN with regional quality variations. Portugal combines excellent quality rankings with affordable private insurance under €120 monthly.

Language: Limited English in public systems requires private healthcare for comprehensive English services. Growing medical tourism sectors provide dedicated English-speaking services in major cities and coastal regions.

Eastern Europe

Poland, Czech Republic, Hungary, and Estonia offer cost-effective healthcare with improving quality metrics and growing medical tourism sectors.

All underwent major post-1989 healthcare reforms, creating mixed public-private systems with varying patient contributions. Quality improvements continue with EU integration and increased healthcare investment. Lower costs attract international patients for procedures like dental work, cosmetic surgery, and specialized treatments.

Waiting Times

Switzerland leads with 2-day GP appointments and 28-day elective surgery waits, supported by high provider density and efficient private system operation. Germany follows with 4-day GP access and 31-day surgery waits, though private insurance holders receive 3x faster specialist appointments than public system users.

Netherlands maintains reasonable 3-4 week specialist waits with GP visits remaining free under basic insurance. Denmark achieved 38-day average hospital treatment waits, returning to pre-COVID performance levels through effective system management.

Cataract Surgery: Ranges from under 30 days in Denmark and Netherlands to over 180 days in Estonia, with 95-day average across OECD countries. Hip Replacement averages 110 days, while knee replacement extends to 140 days average.

European emergency services universally excel, with 99.8% of Netherlands residents reaching emergency care within 45 minutes. All systems provide 100% emergency coverage for residents and visitors, with EU regulations ensuring treatment access throughout the continent.

Language Access

Netherlands provides the gold standard with 95% English proficiency among healthcare workers and dedicated English-speaking GP practices in major cities. Patient portals, digital services, and medical records operate in English, eliminating communication barriers.

Nordic Countries (Sweden, Denmark, Norway, Finland) rank among global leaders for English proficiency, with most doctors and healthcare professionals speaking excellent English. Digital health systems increasingly offer English-language interfaces.

Germany achieves 62% English proficiency with major hospitals providing English-speaking departments and professional interpreter services. University medical centers typically maintain English-speaking staff for international patients.

EU Regulations require treatment providers to arrange interpretation when using European Health Insurance Card coverage. Switzerland provides professional interpreters but patients typically bear costs themselves, with preference for bilingual staff when available.

Nordic countries lead advanced e-health systems with partial English capabilities, while Estonia excels in e-prescription and digital health services. Netherlands provides comprehensive online healthcare portals with English options, and Germany implements electronic health records with English capabilities for international patients.

EU-wide initiatives include cross-border e-prescription services and patient summary sharing through MyHealth@EU, improving healthcare continuity for mobile Europeans.

Recommendations

The research reveals Netherlands as the optimal choice for most expats, combining #2 global ranking, 95% English proficiency among healthcare workers, and straightforward €149 monthly insurance with comprehensive coverage. The system balances universal access principles with private market efficiency, minimizing bureaucratic complexity while maintaining world-class outcomes.

Switzerland serves high-earning expats willing to pay CHF 300-400 monthly for premium services with immediate access and world-leading medical innovation. The entirely private system eliminates public sector wait times while maintaining universal coverage through government subsidies for lower-income residents.

Denmark and Sweden provide Nordic excellence for expats prioritizing comprehensive social services and digital health innovation, though higher tax burden (20-50% income tax) funds these comprehensive benefits. English accessibility rivals Netherlands with excellent digital services.

Spain offers exceptional value for budget-conscious expats, providing universal coverage and world-leading health outcomes (83.5-year life expectancy) at minimal cost for legal residents. However, limited English services in public systems may require private healthcare for comprehensive communication.

Choose Netherlands for optimal expat experience, Switzerland for premium care, Nordic countries for comprehensive social benefits, or Mediterranean countries for cost-effective quality. All European systems provide emergency care for visitors, but long-term residents must navigate local registration requirements.

The European healthcare landscape offers unparalleled global quality with universal access principles, making any choice superior to most global alternatives while requiring careful consideration of language accessibility, cost structures, and bureaucratic complexity for optimal expat experience.

This article is part of the Business Attraction Index. Whether you an expat looking to relocate or a business trying to attract employees, healthcare is an essential part of the equation.