How to avoid bureaucracy and corruption when doing business in Europe

Simple! Avoid doing business in bureaucratic and corrupt countries.

Bureaucracy is always associated with complex and intransparent processes. This leads easily to corruption and cronyism. The delayed or obstructed processes make it very difficult for businesses to operate effectively and can ultimately discourage investment.

The often quoted World Bank’s “Doing Business” report, in 2020 ranked the 10 most difficult countries in the world as: Venezuela, Libya, Sudan, Somalia, Democratic Republic of Congo, Republic of Congo, Central African Republic, Equatorial Guinea, Eritrea, and Burundi. Happily all EU countries were in the top 100, with Greece getting the lowest score a #79. The top EU country was Denmark. However, the World Bank’s “Doing Business” report has received much criticism. Some argue that the rankings are inconsistent and do not always reflect the reality on the ground. For example, in the 2018 edition of the report, Somalia was ranked as the most bureaucratic country in the world. However, in the 2019 edition, Somalia was no longer included in the rankings at all. This inconsistency casts doubt on the validity of the rankings. In 2021 the World Bank announced that it will no longer produce its “Doing Business” report.

Corruption in European countries

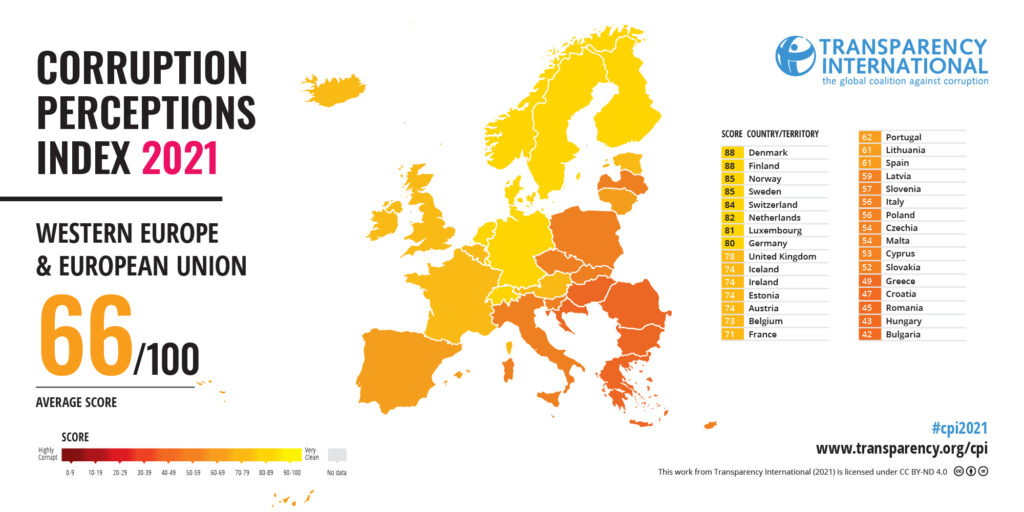

Corruption is a serious global problem, disturbing normal business and livelihoods. Unfortunately corruption remains an issue in too many European countries. In the 2021 edition of Transparency International’s Corruption Perception Index, 19 of the 28 European Union countries were ranked as “clean”, while 9 were ranked as “corrupt”. The Nordic countries, Switzerland, the Netherlands and Luxembourg top the ranking and are considered least corrupt. The most corrupt countries in Europe according to this index are: Bulgaria, Romania, Hungary, Croatia, and Greece.

All of these countries have been involved in corruption scandals in recent years. For example, in 2017, it was revealed that the European Commission had been infiltrated by a group of Romanian and Bulgarian organized crime gangs. These gangs were involved in a variety of activities, including corruption, money laundering, and migrant smuggling.

The least bureaucratic and corrupt EU countries

The 2022 Best Countries Report by WPP and the Wharton School uses 73 attributes for 10 dimensions of “best country”. An analysis of the most relevant categories for new businesses reveals a consistent top 5 countries in the EU’s single market (EU and EEA countries): the Nordic countries plus the Netherlands. These are highlighted in green in the table below.

7 other countries have been placed in a 2nd league (highlighted in orange). These countries have top 10 placings in only 2 relevant categories, indicating weaknesses in their total attractiveness for expanding businesses.

Clearly countries with consistently low ratings, such as most of the Eastern European countries, should be considered as higher risks for business in general. This does not necessarily rule them out as options. Risk can mean opportunity. Nevertheless, more caution is recommended.

Germany has a high score overall, however its miserable score in the critical category Least Bureaucracy, placing it just above Romania, places in the 2nd league. Austria and France also score too low on Least Bureaucracy. Portugal and Ireland are contenders for the top 10, lagging behind just a bit in Entrepreneurship and Overall.

Reducing bureaucracy and corruption

One way to reduce corruption and increase transparency is to use technology. Technology can also be used to combat corruption. For example, the use of biometrics (fingerprints, iris scans, etc.) can help by making it more difficult for people to forge documents or bribe officials. Another way to reduce bureaucracy is to streamline processes and make them more efficient. For example, in many countries, businesses have to go through multiple agencies to get all the required permits. This can be a time-consuming and frustrating process.

Estonia is often cited as an example of a country that has effectively used technology to reduce bureaucracy and corruption. The Estonian government has developed a number of e-business solutions that make it easier for businesses to operate. For example, the “e-Residency” program allows individuals from around the world to apply for Estonian residency online. Once approved, e-residents can then start and operate a business in Estonia completely online. These e-business solutions have made it easier for businesses to operate in Estonia and have reduced bureaucracy and the potential for corruption. As a result, Estonia is often cited as a model for other countries to follow and has gained a top 10 ranking in the category Least Bureaucracy. Unfortunately it ranks lower in the other relevant categories.

To find out which countries are most “digital-ready ” the 2022 IMD World Digital Competitiveness Ranking can be used:

The IMD World Digital Competitiveness Ranking, produced by the IMD World Competitiveness Center (WCC), measures the capacity and readiness of 63 economies to adopt and explore digital technologies as a key driver for economic transformation in business, government and wider society. This year 54 criteria were measured – a mixture of external hard data and the IMD Executive Opinion Survey – and arranged into three major groups: future readiness, knowledge and technology.

Which country to choose?

The choice of a country in which to base a European operation is complicated. The EU’s single market makes it possible to operate in any EU or EEA country. However certainly not all countries are equally attractive. The objective rankings such as in this article should at least be taken into account when making a decision about business location. This may help prevent disappointment at a later stage.

The analysis in this article may be summarized as: work from the North West (the Nordics) to the South East (Greece and the Balkans) when considering a location for a new business in Europe!

Want to explore further? Read much more in our complete comparison of the best countries in Europe for doing business. You can also send us your questions in the form below.